Some fresh consumer debt stats for you (A mix of December 2019 & April 2020 data)..

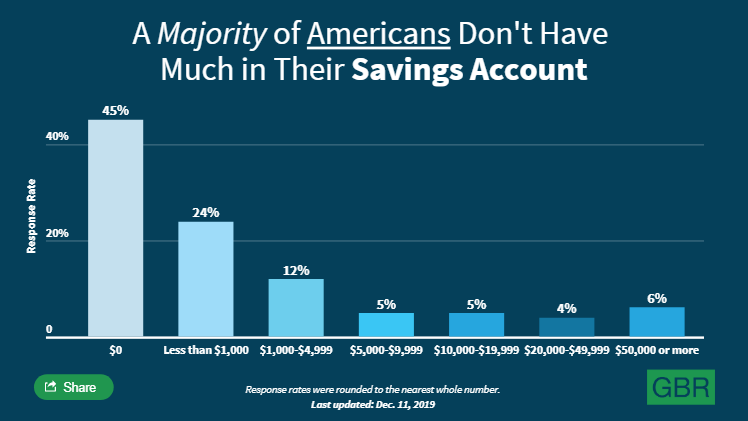

According to a survey ran in December 2019 by GoBankingRates, 69% of respondents said they have less than $1,000 in a savings account, compared to 58% in 2018. Keep in mind this was in the height of 11 years of expansionary market and right when the stock market kept printing all time highs.

“It’s puzzling to me that if the economy is doing so well and that we’re so close to full employment, that consumer confidence is up … that we haven’t seen the numbers move much in people’s ability to save,” said Bruce McClary, spokesman for the National Foundation for Credit Counseling.

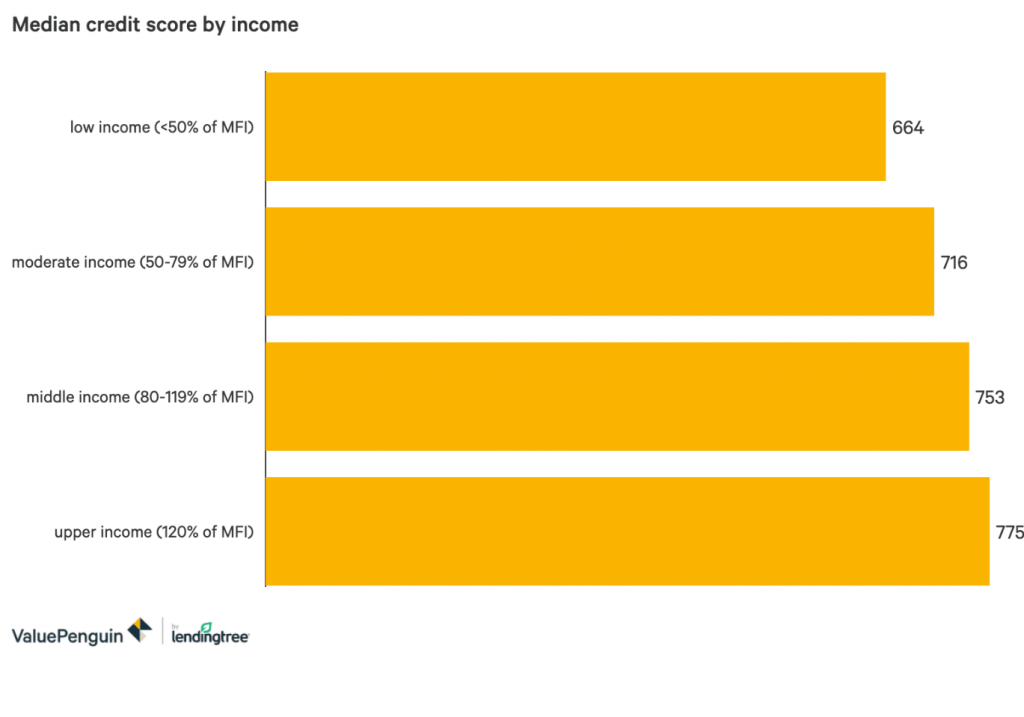

As you would expect, credit scores get better as individuals get older and the gap between excellent and average scores becomes greater.

You would be right if you thought there would be a correlation between bad scores and low income, here is how that data looks.

With half of the planet still on lockdown due to the Coronavirus breakouts, its obvious to see that will have an impact on consumer debt levels and credit scores.

First off, over 2 million people have filed for mortgage forbearance so far, which allows them to delay mortgage payments- keep in mind this doesn’t stop the lender from reporting late payments to the credit bureaus. That means 2 million people will get a fresh negative ding on their credit report affecting them upwards of -100 points as this is a mortgage debt.

A more general chart to look at here is the overall arrangements for bad debts at the major US banks has jumped up to numbers we saw in the Great Financial Crisis (GFC 2009).

Wallet Monkey uses affiliate links on our site to make revenue so we don’t have to jeopardize our integrity with credit product reviews. Learn more about this.

If you want to take your credit game to the next level check out our products & services

Wallet Monkey uses affiliate links on our site to make revenue so we don’t have to jeopardize our integrity with credit product reviews. Learn more about this.

If you want to take your credit game to the next level join our Private Discord or checkout our Credit Mastermind.

Disclaimer: WalletMonkey strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

It looks like you need to register or login to view this page.

Registration is currently FREE!