Treat Your Credit Score Like A Plant That You Constantly Take Care Of And It Will Pay Dividends When You Need It The Most!

A credit score is a number that is assigned to every US citizen and resident that represents their ability to manage loans they have and pay their bills on time. This score is based on different algorithms that factor in how much credit you have open, what type of credit it is, your credit line and your ability to manage and pay on time. The scores for the most popular credit rating systems currently range from 300-850 but many credit unions and institutions use their own internal rating system to help identify credit worthiness.

A lower credit score is usually assigned to someone with not much information on their credit profile or to someone who has derogatory marks, as reported from the lenders and banks they currently have open lines of credit and loans with. A person with a lower score is often times not only rejected from getting certain loan types and credit offerings but will also find themselves paying a higher interest rate on the cards they do have open. Where as someone with a higher score is often times offered 0% interest for promotional periods as well as offered most major credit card/loan offers as long as income backs that data up.

When lenders request to check your credit this refers to them pulling your credit report from either one or all three credit bureaus which are Experian, Equifax and Transunion. They may pull the most recent report in full which is called a hard inquiry or “hard pull (hp)” for short which affects your credit score and your ability to get new credit/loans with other banks as it reports as an “inquiry” from that institution. The second way a lender may check your credit file is they may take a quick look which is called a soft inquiry or “soft pull (sp)” which doesn’t affect your credit report and credit score.

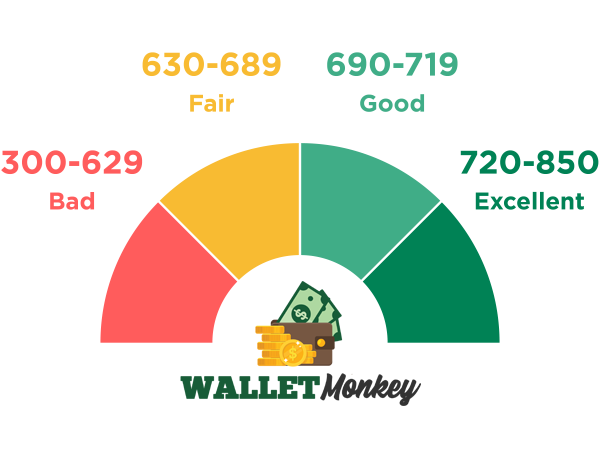

Credit Score Ranges

The most popular credit scoring models currently work off a range of 300 to 850 to gauge credit worthiness, and that is the VantageScore system and the FICO models. The fico models to bring in another level from 800-850 that they call excellent and move everything down a bit from there but in general these credit score ranges are the standard and you can base APRs etc off that.

| Score range | Credit type | Credit Card APRs | Loan APRs |

| 300-629 | Bad | 24%–32% | 15% – 35.99% |

| 630-689 | Fair/Average | 17.8%–19.9% | 10% – 15% |

| 690-719 | Good | 13.5%–15.5% | 10% – 15% |

| 720-850 | Excellent | 10.3%–12.5% | 5.99% – 10% |

- Excellent Credit: This should qualify you for the best APR and the most sign up bonuses (SUBs)

- Good Credit: This should qualify you for upper tier APRs (just below the best) and you will still get SUBs

- Fair Credit: You will get no SUBs, and your interest rate is getting into the 20%+ at this point

- Bad Credit: Highest APR, highest risk in the eyes of the bank

Currently 67% of Americans have a “good” FICO score (670 or higher) and 62.5% of Americans have a “good” VantageScore. The average FICO score in the US is 716, and the average VantageScore credit score is 695, both of which are considered “good” credit scores according to 2022 data. Get even more credit rates, requirements and data.

Average FICO Score By Age

| Age | Average FICO Score | Average Vantage 3.0 |

| 18-23 | 674 | 654 |

| 24-39 | 680 | 658 |

| 40-55 | 699 | 676 |

| 56-74 | 736 | 716 |

| 75+ | 758 | 729 |

Credit Scoring Models

By far the most popular credit scoring models are FICO and VantageScore, but I wanted to give you a complete list of all the most popular scoring models.

| Scoring Model | Range |

| FICO | 300-850 |

| Equifax | 280-850 |

| TransRisk | 300-850 |

| Vantage Score 1 & 2 | 501-990 |

| Vantage 3.0 | 300-850 |

| PLUS score | 330-830 |

| Experian National Equivalency Score | 360-840 |

Video: FICO Models Explained

Going Beyond Your Credit Score

There are also other ways now many institutions and Fintech companies are using to determine credit worthiness beyond your credit score. The most common way that is used beyond your credit report is whats called DTI or debt to income ratio. That represents the total debt you carry on all your credit cards/installment loans divide by the amount of income you claim you make. This is why its so important to keep your credit utilization rate below 10% to set yourself up for the best chances of getting fresh credit (when you are seeking of course). Other newer ways are to use api services like Plaid to connect up your checking account for them to review how you handle your finances. Naturally with most loans and higher credit approvals you will be required to present proof of income (POI) in the form of bank statements (2-12 months) and/or W2s from the last filing (2019-2021). The only reason banks are more flexible here with tax returns is because the IRS is so far behind still from covid-19.

What Factors Affect Your Credit Score?

The main credit scoring systems FICO and VantageScore that we have been covering take into consideration pretty much the same factors, even though they weigh them slightly different.

Paying your bills: Your payment record on all open credit lines and loans accounts for 35% of your credit score (or there abouts) currently, which means that the most important factor to improving your credit score is your payment history.

In January 2020, 8.1% of credit files included a 90+ day missed payment during the previous 6 months. By July 2020, that number was down to 7.3%. Even though the pandemic has been very hard for many financially, this is a very positive sign.

How much you owe: Your credit balance in relation to the overall credit limit represents 30% of your credit score, this can be calculated by your credit utilization rate. You often hear people telling you that the norm is to keep it below 30%, but in fact the sweet spot is no more than 9% utilization if you want the highest chance of CLIs and APR reductions.

The average credit card debt in America is $5,315, in 2019 it was $6,194, which is a 14% drop.

Here are the other factors which matter much less…

Credit Age: The length you have had your credit accounts opened does matter quite a bit when you are building your credit or rebuilding your credit, insitutions will constantly put that down as a rejection reason. Length of credit history accounts for 15% of your credit score.

Credit Diversity: The range or types of credit you have- revolving, installment, mortgage, car loan etc. Credit mix accounts for 10% of your score.

Actively Seeking Credit: New credit accounts for 10% of your credit score.

How To Monitor Your Credit Score

The great news is that there are many free apps now that offer you free access to a version of your credit report, most of your popular bank and credit card applications will also offer a credit score tracker for either your VantageScore or your FICO. We wrote a complete list of all credit report and banking resources where we get into a complete list of all the places you can get a free credit report and/or track your credit score- there are now hundreds of ways to get it.

Frequently Asked Questions

What is a credit score?

A credit score is a number that summarizes your credit risk to lenders, based on your most recent reported data to the credit bureaus. This credit profile helps lenders evaluate your credit worthiness which determines the limits and interest rates you get on your credit cards and loans.

What are FICO scores?

Your FICO Score is a three-digit number calculated from the data on your credit reports at the three major credit bureaus —Experian, TransUnion and Equifax. Your FICO Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO Scores to help them quickly, consistently and objectively evaluate potential borrowers’ credit risk.