By far the number one question I get asked on a regular basis is some variation of “how to boost credit score fast”! Its no wonder why the public’s view on credit scoring and debt is so skewed, remember public perception of topics is based on their understanding of it- hence the divide in good/bad ideals.

I think a great place to start this guide is to thoroughly go over all the “basics” and pieces of a credit score and break down how these are really used in the primary scoring models.

Fun Fact: Did you know there are 11 scoring models actively used and supported by lending institutions all over the US? From 16 models of the FICO model to VantageScore 2.0-4.0, they all look at the same variables just put weight on different aspects of it.

Since there are multiple models used in scoring of someone’s credit profile I will be covering the two major systems which are VantageScore and FICO. FICO by far is the most widely used by banks and lending institutions so lets start there. Your credit score rating works off of what are called credit score ranges, which determine your credit worthiness.

FICO Scoring Explained

As I mentioned above FICO has many different scores for you that are tailored to specific lending purposes, such as mortgages, loans and credit cards. You can see this in your Experian account if you click over to the “FICO scores” page.

“It’s probably the No. 1 or No. 2 misunderstanding about credit scores that there (isn’t) more than one FICO score,” says Kenneth Lin, CEO of consumer finance and technology company Credit Karma. “A consumer literally has three to four dozen FICO credit scores.”

The first FICO scores were started in 1989, which originally set out to predict the likelihood a consumer would become 90 days behind on payments over the next 24 months on different debt types. Since then many changes have been made to the new versions which have worked their way up to FICO 9.0 now.

For example, FICO 8 which was introduced in 2009 in the midst of the Great Financial Crisis (GFC) penalizes isolated late payments less than previous scores, but punishes high balances on credit cards more. It ignores collection claims less than $100 and it reduced the benefits of authorized user accounts.

FICO 9, which has been available since 2015, treats medical debts less severely and bypass paid collection accounts entirely.

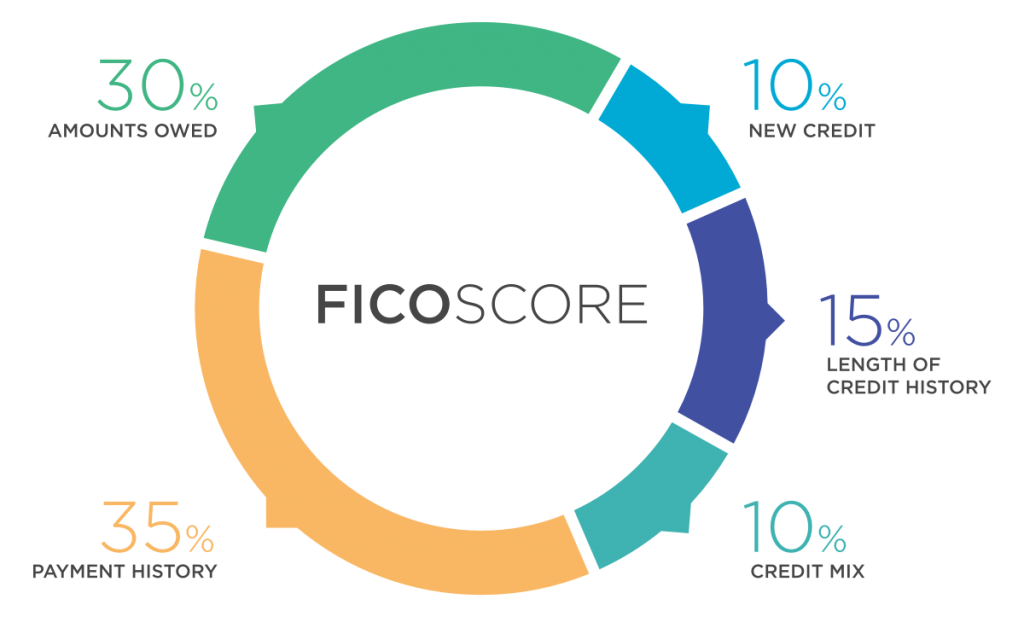

Most people don’t know this but in the summer of 2020, they will start rolling out FICO 10, more on that in a few minutes- lets take a step back here and talk over the main ranking factors that FICO uses, aka the pie chart!

This is how FICO ranks your credit factors!

So just by looking at that chart we see that 65% of your score is based on utilization and payment history, so if you just focused on those two you would be ahead of 90% of credit profiles! More on this later

FICO 10 Changes

There are in fact 3 big changes I want to talk about with FICO 10 which should be very concerning to your average joe!

- Profile Snapshot- Creditors will be able to look back and see 24 months of payment history which they will take into consideration when approving/denying cards and loans. This means that if you run up your card and then pay it off by the time statement dates hit, you could be looked at as higher risk because you are using more of your available credit.

A strategy I strongly advise clients is to actively be adding tradelines till you have enough open (20+) that you can balance tens of thousands in spend across your cards without going over 10% usage. So this strategy will work even better with the FICO 10 changes. - Rate of Credit Change- FICO 10 will also report and track the rate of credit you’re getting over time and weigh that into the decision process. For example sites like Prosper, Upgrade and Marcus By Goldman offer balance transfer personal loans to knock out high interest credit cards, so this will be tracked now and your score will be negatively impacted if you run out after getting that loan, get a bunch of new credit and max it out. So personal loans will now be taken more serious. In fact, its safe to assume that just getting a personal loan could negatively impact your credit score.

FICO 10 will also pay more attention to patterns in your credit usage and attempt to map that onto a typical bell curve based on age and assumed responsbilities that occur naturally throughout life (getting married, home purchase, cars, kids etc) and they will be looking for that natural growth. This means it will officially root out any nefarious companies that claim to add debt to your credit profile as that will no longer work. - Short Term High Balances- This will not be penalized, so if you have a big one time purchase, or end of the year tax payment to make and max out the card, that will be taken into consideration better than it was before and won’t negatively impact your score. Remember they are looking at consistency here which is how/why they can write off a one-time event.

Key Takeaway: FICO 10 will be more pivoting into better credit management, keeping utilization lower and paying on time which means that overall great financial habits will be rewarded.

Vantage Scoring Explained

Since FICO is the primary model used (over 90% of top lenders use according to Credit Karma), I spent the most time there but lets now turn our attention onto the Vantage scoring model which is also important to understand the subtle differences. VantageScore model was created in 2006 by the major consumer credit bureaus Experian. Transunion and Equifax- to create a “more predictive scoring model that is easy to understand and apply”.

The following sites can be used to track your VantageScore- Most credit cards (Amex, Capital One etc) offer a free credit tracker, these are based on your VantageScore. Outside of that you can use Credit Karma, Wallethub or Credit Wise (owned by Capital one now).

VantageScore groups credit information into six main categories, but the categories don’t work off a % rating, they work off influence level on your scores.

- Payment history: extremely influential

- Age and type of credit: highly influential

- Percentage of credit limit used: highly influential

- Total balances and debt: moderately influential

- Recent credit behavior and inquiries: less influential

- Available credit: less influential

So again credit utilization (how much of total credit limit used) and payment history are at the highly influential end as is age and type of credit (mortgage, revolving, charge, installment, etc).

This is why you can see such a staggering difference between your FICO 8 scores and VantageScores when checking your reports. Its not uncommon to see a 20-40 point difference.

Credit Score Ranges

Both FICO and VantageScore ranks credit worthiness into credit ranges as you see below, we are basing this off the FICO credit score ranges, Vantage vary slightly.

| Score range | Credit type | Credit Card APRs | Loan APRs |

| 300-629 | Bad | 24%–32% | 15% – 35.99% |

| 630-689 | Fair/Average | 17.8%–19.9% | 10% – 15% |

| 690-719 | Good | 13.5%–15.5% | 10% – 15% |

| 720-850 | Excellent | 10.3%–12.5% | 5.99% – 10% |

Boosting Your Credit Score In 30 Days!

The part you all have been waiting for, now that you better understand how your score is calculated we can now talk about what needs to be done in order to get a dramatic point bump in as little as 30 days. This is for anyone who is looking to get the best possible interest rate on new tradelines, mortgage etc.

- Lower Utilization- This can be done by making a larger payment on your cards BEFORE the next statement date, or go back through all your cards and submit for CLIs (credit limit increase) on all your cards! Make sure you ask if they do a HP (hard pull) and if they do, you may not want to do that.

- Catch up late payments- This is still a big factor so if you were late for your first time, make the payment immediately and then call them and ask for forgiveness as it was your first time- keep calling back till you get someone who says yes. If it helps print out a tracker each month with payment dates and statement dates so you can stay aggressive over the next 30-90 days while you working to boost your score

- Remove collection accounts- This is harder to do as it requires a multiple stage approach (plan for 4 rounds of letters) if you want to try to get them removed at the bureaus directly or you can contact the creditors and work out a deal. I suggest you don’t confirm your identity until they agree on a deal which includes them getting the debt removed completely off your file. They will not be nice to you and will try to trick you- keep that in mind!

- Wake up old cards- Ideally you want to keep using cards at least once every 3-6 months, otherwise you run the risk of the creditor closing the account aka calling in the loan or lowering your credit limit which will negatively affect your credit score. Stay on top of this!

- Get New Credit- Opening up new tradelines even though might drop you a point or three from the inquiry, the score will go up more when the new account starts reporting in 30-90 days.

- Become AU- Authorized user accounts or AUs still work very well as long as they are done strategically, meaning you don’t want to get added to a card that has ever been late or had a utilization above 30% or its not a valuable. Also for you to be an AU on a card from the same lender you are looking to get a new card with is a great idea.

- Keep Payments On Time- Keeping up with payments is pretty simple once you create a process for it so I suggest to make a simple tracker will have a sample of one below, and then set the payment date reminders in Google Calendar (free) with alerts on your phone so you don’t miss them.

Credit Repair & Remove Inquiries

If you need help getting old inquiries removed or actual credit repair then reach out to our suggested provider below. We will get a referral bonus if you sign up for their service, this is not why we are offering this, in fact over the years we have only suggested two companies, this being the second one. Legit credit repair is hard to come by.

Remove or Repair Credit With Crown Credit Repair (Use our affiliate code 608101444 if you like if not that’s ok too, they are worth it) You can also call 1-833-276-9645 extension 2 to speak with representative

Sample Payment/Statement date tracker

| Tradeline | Bill Date | Statement Date |

| Chase Amazon | 6th | 9th |

| Amex | 6th | 10th |

BONUS TIP: Until FICO 10 comes out and banks adopt using it, play the game. Shuffle around credit card usage and paydowns around statement dates to get credit score bumps throughout the month and get yourself into position. Keep in mind these bumps will have a very limited window and will depend on how well you can juggle between the statement dates. Payments usually take 1-4 days to post to bureaus after payments are made.

Monitoring Your Credit

In case you aren’t already weekly checking in on your credit, here are some free and paid tools you can use. I will edit this list as things change! Currently Annual Credit Report is still offering a free weekly credit report and has been since the start of the Covid-19 breakout.

VantageScore

- Credit Karma– FREE but you only get Trans & Equifax data once per week

- Credit Wise– FREE but you only get Transunion data once per week (Capital One owns now)

- Wallet Hub– FREE but you only get Transunion data once per week

- Identity IQ– Paid but gives all 3 VantageScores daily, full report on all 3 once per month- broken down in an easy to understand way. $1 trial for 7 days then $28 per month

FICO

- FREE FICO- Check out FICOs Open Access program to see who offers a free FICO score. Many banks and institutions offer a free FICO now through this program. (Bank of America, Citibank, PNC, Navy Federal, Discover to name a few)

- Free Credit Report– FREE but one time and just Experian

- Experian Account– All 3 FICO scores one time for $40 or once per month starting at $14.99 (free 30 day trial)