This page will feature all the tradelines we can find that are worthy of being talked about. The meaning of a tradeline has now changed so much since 2016 when I first got started, back then these were online only accounts where you could buy mostly overpriced junk from their “shop” and they would report a revolving tradeline of $2k-$10k to the credit bureaus.

I used to have a MyJewelersClub and NewCoastDirect tradeline, easy $10k in tradelines back then. You could truly get some of these tradelines with the worst of credit scores, believe me I used to have one.

When it comes to bad credit, I can talk about this inside out and outside in because years ago I used to have a 463 credit score and had 0 clue what I was doing.

The core ethos of a “tradeline” is still the same, its a credit line you can get to report on your credit thats usually going to use an alternative means of approving you (so they either guarantee approval or don’t pull credit). Nowadays with so many fintech’s that is things like linking up your primary checking account or similar.

Chances are if you are rebuilding credit you have whats called a “thin file”, this just means you have 5 open accounts or less reporting on your credit and probably no non-revolving credit like loans or mortgage.

How we can thicken up our file to 10+ tradelines (minimum you want to be at before going after larger tradelines like business credit etc) is by getting these tradeline accounts.

I will write an article on best Credit Cards for bad credit, but for now lets talk about tradelines. These can be a savings account that you fund each month, these usually report as an installment loan (helping with credit mix), they can be a line of credit (usually based on your direct deposits), getting your rent or utilities payments added to your credit profile, paying for subscription services you already use and even cell phone service.

This helps those with bad credit by thickening up their profile and thinning out their utilization (they have more available credit being reported on their file), which both help bump your credit score. I literally did this when I had under a 500 score, a BK (bankruptcy) and collection accounts and my account jumped up to mid 550s just from one of the accounts I am about to share with you.

Savings Based Tradelines

With these savings loans/savings based tradelines the concept is simpe; you pay monthly and at the end you get all your money back, they report it to the bureaus as an installment loan (most of them anyway).

| Institution | Monthly plans | Reports As | Reports To Bureaus | Additional Fees/Notes |

|---|---|---|---|---|

| Self Inc | $25/24 months $35/24 months $48/12 months $150/12 months | Installment loan | All 3 | $9 admin fee 12.44%-15.97% interest rate/APR |

| Credit Strong | $28/48 months $38/36 months $48/24 months | Installment loan | All 3 | $15 admin fee 15.51%-15.73% APR $1,000-$1,100 tradeline reported Instant approval |

| Kovo | $10/24 months | Installment loan | All 3 | no credit check instant approval 0% interest/ $0 fee You're buying courses 30 day refund |

| Kikoff | Revolving/Installment | Eq & Ex or Eq & Tu | no credit check 0% interest/ $0 Fees Reports $750 tradeline |

|

| Meetava | $21 p/m | Installment loan | All 3 | 12 month commitment, can't end early |

| Loqbox | Installment loan | All 3 | 0% apr you pick amount |

|

Self Inc works like a CD, you select the amount you want to pay each month (starting at $25 per month) and can close anytime you want. No hard inquiry, guaranteed approval and reports as Atlantic Capital.

After 3 months you qualify for Self Inc Secured Credit Card, reports as new revolving account, use your credit builder account balance to fund.

Example

- Say you apply for a loan of $840 at an interest rate of 14.70% and APR of 15.97% — common rates for people trying to rebuild or establish credit.

- You pay a one-time, nonrefundable administrative fee of $9.

- The monthly payment could be $35 per month, meaning you would need to pay that amount per month for 24 months.

- As long as you make all of your payments on-time for 24 months,, you could get $724 back. — meaning the bank kept $116 in interest. In addition, you get a chance to build positive credit.

Credit Strong offers a range of products for both personal and business, you start with an installment loan or revolving credit line product and pick what terms you want. Similar to Self.

Credit Strong also offers a revolving credit product which will report a $500 revolving credit line for you, there is no credit card issued, you can only advance money off that account to help fund an installment loan product. There is 0% interest and also a $99 annual fee with this account, reports to all 3 bureaus like all their products.

Here is full amortization schedule so you know how much you pay in interest.

Kovo Credit

What you are doing here is purchasing Kovo Courses on credit, with Kovo Installments.

Courses are created by instructors to help you hit your goals. While these courses are all together valued at over $400, we make them available as a collection for $240.

Included are the following interactive courses:

– Job Interview Skills, Interview Strategy & Answer Scripts

– Self Confidence & Self Esteem: Confidence via Self-Awareness

– Entrepreneurship: How To Start A Business From Business Idea

– Personal Branding Path To Top 1% Influencer Personal Brand

– Stress Management With Time Management For Burnout & Anxiety

– Entrepreneurship: Sales Training, Techniques and Methods

– Ecommerce Bootcamp Academy

– Google Sheets Fundamentals

– Intro to Programming

Rewards

After 4 on time payments you may qualify for 1% interest on your loan.

Rewards provide a way for Kovo customers to earn gift cards when opening a loan or credit card offered by some of our featured lenders and card issuers. Rewards are calculated as 1% of the value of a personal loan issued (up to $500 gift card), student loan issued (up to $250 gift card), student loan refinance issued (up to $250 gift card), auto loan refinance issued (up to $150 gift card), and $75 gift card for a credit card issued.

Kikoff

Kikoff offers 2 products:

- Kikoff Credit Account – this is a revolving line of credit. This account builds monthly payment history and helps reduce your credit utilization.

- Kikoff Credit Builder Loan – this is an additional product for customers with positive payment behavior on Kikoff products. Credit Builder Loan is a 1-year savings plan for $10/month.

The Kikoff Credit Account is a revolving line of credit that gets reported to Equifax and Experian.

You are able to use the Kikoff Credit Account to finance the purchase of goods and services from Kikoff.

Unlike a credit card, the Kikoff Credit Account can only be used to make purchases from Kikoff (e.g. can’t buy gas or groceries). There is no physical card with the Kikoff Credit Account.

Please note that reporting depends upon which Kikoff products you have:

- Kikoff Credit Account reports to Equifax and Experian.

- Credit Builder Loan (optional add-on) reports to TransUnion and Equifax.

They also offer a credit builder card, we will cover that further down on this page.

Loqbox

Decide how much you can save into your Loqbox each month for a year. We finance the full amount with a 0% APR loan (issued by our finance partner Loqbox Finance LLC). Think of it like a digital piggy bank.

Let’s say you wanted to save $1,200 in a year. We sell you a Loqbox in that amount and issue you a 0% APR loan to pay for it, which you repay in 12 interest-free monthly payments of $100.

We get paid by our partner banks for introducing them to new users, which is how we keep Loqbox free. But if you’d prefer, you can opt for our Flexi Unlock premium add-on and unlock into an existing account for $40.

Rent Tradelines (Tenant)

These are all the report your rent style tradelines where the tenant pays.

- Rent reporters

- There is a one-time enrollment fee of $94.95, which includes up to two years of reported rental payments. From there, you can enroll in a monthly plan ($9.95 per month) or an annual plan ($7.95 per month). Rent Reporters reports to TransUnion and Equifax.

- Boompay

- There is a one-time enrollment fee of $10. You can pay $2 a month to report your rent payments from this point onwards or $25 one-time fee for up to 24 months of past payment history. Boompay reports to all 3 bureaus.

- Rental Kharma

- Initial setup is $50, and the service is $8.95 per month. Reports include all past history at your current address. You can include your roommate or spouse for a $25 one-time fee and an extra $5 per month. Rental Kharma reports to TransUnion and Equifax.

- Level Credit

- Previously known as RentTrack, LevelCredit charges a $6.95 monthly fee to have your rent, cell phone and utility payments reported to the credit bureaus. Rent is reported to all three bureaus, while utility payments are reported to TransUnion only. A look-back of up to 24 months is available on your current lease for a one-time fee of $49.95.

- Rock the Score

- There is an enrollment fee of $48, and ongoing service costs $6.95 per month. There is a $65 fee for reporting up to two years of rental history. Rock the Score reports to TransUnion and Equifax.

- Creditmyrent

- This service charges a monthly fee of $14.95, with no setup fee. There are additional charges if you want past rent reported. CreditMyRent reports to TransUnion and Equifax.

- Payment report

- A $49 setup fee gets you two years of rental history reported to Equifax and TransUnion. Ongoing reporting is free for the flat-rate plan, and you can add a roommate or spouse for free. Ongoing reporting for monthly plans costs $2.95 a month, but there is no setup fee. (PaymentReport also has a version offered through landlords that requires electronic rent payments.)

Rent Tradelines (Landlord)

These are all the report your rent style tradelines where the landlord pays.

- ClearNow

- This service debits your rent from your checking or savings account. There’s no cost to you as a tenant, but your landlord must be signed up. If you opt in, payments are reported to Experian.

- PayYourRent

- Fees are typically paid by management. PayYourRent reports to all three credit bureaus. Residents can opt in or out at anytime.

- Esusu

- This service reports your rental payments to all three major credit bureaus. It’s free to you as a renter if your landlord has a service agreement and if you’re not part of the Positive Rent Payment program. Esusu sends an enrollment email to renters to initiate the set-up.

- Boompay

- This service is for property managers and land owners, their BOOM report encourages on-time payments by offering to submit rent data to credit bureaus. They also have BOOMSPLIT in beta which is a flexible rental loan for renters with cash flow issues.

- Jetty Credit

- Also part of Fannie Mae’s pilot program, Jetty is free to renters who live at participating properties. Jetty reports rental payments to all three credit bureaus, and tenants are automatically enrolled.

- Bilt Rewards

- This program lets renters at participating Bilt Alliance properties earn rewards by reporting their rent through the app for free. This service is optional, and renters should receive an invitation when they move in. Renters who do not live in one of these properties can still earn by using the Bilt Mastercard. Renters can earn points to go toward future rent payments or can transfer points to airlines and hotels. Benefits accrue based on tier status, ranging from blue to platinum. The service reports rent to the three major bureaus.

- Rent Dynamics

- A service aimed at multifamily landlords and property owners that is part of the Positive Rent Payment pilot program. It reports on-time paid utility bills to all three credit bureaus and can retrieve up to 24 months of payment history. Renters should contact their landlord for information about enrollment.

Utilities & Cell Phone Payment Tradelines

- eCredable

- This service allows you to report Cell phone, utility accounts and even internet services. The eCredable Lift costs $24.95 per year and will report your utility payments to Transunion. eCredable Liftlocker costs $9.95 per month and will report your utility payments to Transunion, offer credit monitoring, credit score simulator and spending & cash flow analysis.

- Experian Boost

- This free service is offered inside your Experian.com account and offers you to connect up your utility bill, some cell phone bills and subscription services (through your provider, note not all providers accepted) and will begin reporting this to your Experian credit report. They will also only report positive payments on this and users report a 3-10 point jump when starting to use this.

Subscription Services Tradelines

There is a growing group of credit products that simply cater to those who already are paying for subscription services (most of us) and want to get a credit bump.

This is a simple credit builder that allows you to build credit through monthly subscriptions you are probably already paying for. You link up your bank account and they offer 3 different plans, you are simply moving over your auto-payment from your bank account to your Grow credit account for each subscription that qualifies. No hardpull on your credit, they even offer a plan if you don’t get approved for their core 3 plans, they report to all 3 bureaus.

Grow Credit offers three plans:

- FREE plan gives you a monthly spending limit of $17 per month

- Grow membership is $4.99 (up to $50/monthly spending limit)

- Accelerate Membership/ top-tier premium plan is $9.99 (up to $150/monthly spending limit).

This is probably the best service offering like this on the market.

No credit check, no interest, no deposits and Reports to all 3 bureaus.

No reported limit to bureaus, instead it takes every bill you give it and pays it (once you set all that up) through a virtual credit card and then reports those as paid payments to bureaus

Offers 3 different membership plans (Membership fee charged on date of signup each month)

- Lite: $4.99 p/m (up to $500 in bills)

- Prime: $9.99 p/m (up to $25k bill limit)

- Premium: $19.99 p/m coming soon

This is single-plan offer, the credit limit reported is $2500 and you can use up to $25 per month on subscriptions, there is a large (not as much as Grow credit) list of subscriptions.

No interest, no fees, instant approval. Reports to all 3 bureaus.

Credit Score Basics

I think before you even go down the road of “building credit” you need to decide if you’re going to play in this game or not. If not, then don’t bother doing any of this, invest in things like Gold and hold cash- done! If you decide to play the game, you must learn then you must realize this is a long term part-time job to keep up with your credit score, removing old inquiries/items and of course protecting your identity. Start with understanding what is a good credit score and the credit scores ranges, go from there. Honestly with the direction of the global tide, it is becoming harder and harder to stay out of the credit game as its now so closely tied into things like identity protection.

When you turn 18 and your credit profile technically starts being built, there isn’t anything on it, so its considered a “thin file”, this is technically considered bad credit to lenders regardless of credit score at that time. There are very few banks who wouldn’t take that into consideration.

Anything below a 630 credit score is considered a bad credit score, and the lower your score the lower your likely hood of approval and if approved, it usually comes with you paying a higher APR. This isn’t true with the above mentioned tradelines as those are usually flat APR, no change!

HOT TIP: Right now you can keep up on your credit score for all 3 bureaus weekly for free from Annual Credit Report originally due to covid, but now they keep extending it.

Credit Score Ranges

| Score range | Credit type |

| 300-629 | Bad |

| 630-689 | Fair/Average |

| 690-719 | Good |

| 720-850 | Excellent |

What Causes Bad Credit?

Bad credit is usually the cause of neglect on some level, whether its late payments, collections, closed accounts (from the creditor) or public records IE: bankruptcy (BK) and lastly high utilization (just because you have a $5k card doesn’t mean they want you to use all of that, the rule of thumb is 30% utilization or less on your whole profile but in reality they want to see 9%).

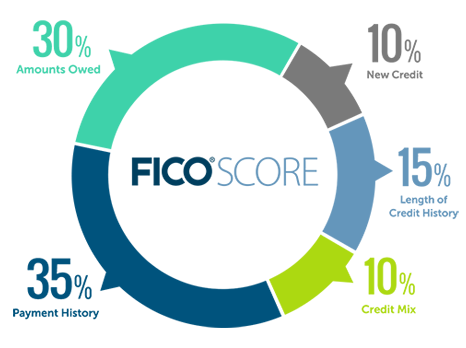

There are five factors that make up your credit score, we wrote a guide outlining how to boost your credit score in 30 days or less, where we break down the credit profile factors but here is a quick look.

- Payment History- This is the single biggest factor on your credit profile, within the FICO model it currently accounts for 35% of your credit score, even just one late payment can have a huge impact on your credit score. If you’re missing a payment by a day or two, most won’t report that as late as long as its being paid before the statement date (even that is risky, and why bother doing that?), anything after that is a late mark on your report. The credit bureaus want to see consistent payments on time from you.

- Amounts Owed- This is also called credit utilization or the amount you have spent compared to the credit line you’re approved for on revolving credit lines and mortgages/car loans/etc even though those are ranked a little differently. This accounts for 30% of your FICO score. As I mentioned the standard is 30% max utilization on your whole profile (so every card combined should leave you at 30% or less) but the unspoken rule of thumb is 9% across the boards.

- Length of Credit History- The length of time you have had your revolving and installment loans open accounts for 15% of your score on the FICO model, the older you have accounts the better. Again the credit bureaus want to see consistency.

- Types of Accounts- The credit mix accounts for 10% of your FICO score and this is the blend of revolving accounts (credit cards/charge cards) and installment loans (mortgage/loan).

- New Credit- When you get new credit cards or tradelines expect to lose a few points from the hard pull (HP) but after the new tradeline starts to report (and report with a low utilization) then your score will jump up more than the initial point drop, this accounts for 10% of your FICO.