On this page we will give you a complete idea of the primary and secondary credit bureaus for business credit and accompany that with other resources related to that. Most people don’t know that there is actually 13 credit bureaus and data aggregators used on the business side to report your credit score and account data.

Here is the data that is shown on your business credit reports

- Business credit reports list

- Details on payments the business has made for each individual account

- Full payment record

- Upper-credit limit

- How much they currently owe on each account

- How much is past due

- What the terms of the account are

- When the account was reported and last updated

- List payment details for each account, they also add detailed commentary to the report indicating payment patterns

- Extra information provided include detailed financial information such as current assets, liabilities, working capital, net worth, sales

- Reports also list payment details for each account and detailed commentary to the report indicating payment patterns

Major Business Credit Bureaus

- Dun & Bradstreet (D&B)

- Experian business credit score (both the Intelliscore Plus℠ and Financial Stability Risk rating)

- Equifax

| Business Credit Score | Score Range |

|---|---|

| Dun & Bradstreet PAYDEX | 0-100 |

| Intelliscore℠ Plus from Experian | 0-100 |

| Equifax Payment Index Score | 0-100 |

| FICO® LiquidCredit® Small Business Scoring Service℠ (SBSS) | 0-300 |

| Equifax Business Credit Risk Score | 101-992 |

| Equifax Business Failure Score | 1,000-1610 |

D&B Paydex Score

Score between 1-100, need an EIN and D&B number to access. With the special calculations that Dun & Bradstreet use, paying your bills on time, and especially early, is key and can work in your favor. If you only pay your bills on their due date, the highest rating you can get is 80, 100-rated payments are those that are made 30 days early.

When it comes to D&B, the Paydex score you get is 100% based on payment history. There is no pie chart break downs here like with personal credit and the amount of accounts you have and utilization doesn’t matter at all. They keep detailed notes on what you do and how you do it, so here with business credit it’s all about how good your payment habits are. Dun & Bradstreet covers over 30 million businesses.

Experian Intelliscore℠ Plus

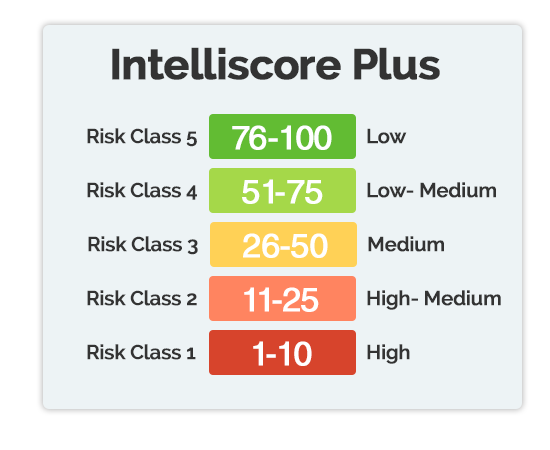

Experian attempts to determine the likelihood of serious delinquency by your business for the next twelve months, all based on the business data available. Just like the PAYDEX score, the Intelliscore℠ is measured on a 1-100 scale, a credit score rating of 1 being the highest risk, 100 being the lowest.

The Experian Intelliscore℠ is determined by over 800 commercial and owner variables including tradeline and collection information, recent credit inquiries, public filings, new account activity, key financial ratios and other performance indicators. Experian covers 27 million businesses.

Equifax Business Credit

Equifax provides you with 3 different scores: Payment Index, Business Credit Risk Score, and Business Failure Score

Your Payment Index score is your typical credit score. This is a number between 1–100 with 1 being the worst score and 100 being the best score. The number is based on your business’s payment history. If you pay your bills on time, your score will be between 90 and 100. If you have even one bill that is between 1 and 30 days past due, your score could drop to between 80 and 89.

Having bills 31 to 69 days past due will drop your score between 60 and 79. A score between 40 and 59 reflects bills that are 61 to 90 days past due, and a score between 20 and 39 is for bills that are 91 to 120 days past due. If you have bills later than that, you can expect a score between 1 and 19.

Equifax business credit risk scores range from 101 to 992, with a higher score correlating to lower risk. In general, a score over 556 is considered good while a score of 0 indicates bankruptcy.

Your Equifax business failure risk score is a number between 1,000 and 1,610, with a lower score indicating a higher risk of your business ceasing operations within the next 12 months. This score is determined using commercial demographic data, credit and payment information, and company legal records. Equifax covers 25 million businesses.

FICO LiquidCredit Small Business Scoring Service (SBSS Score)

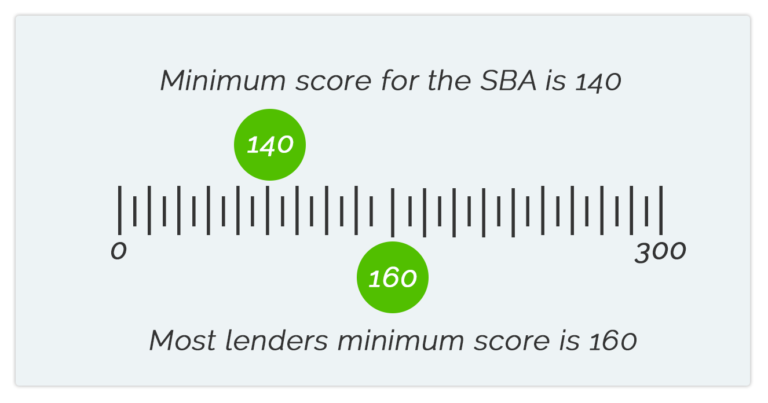

The SBSS score ranges from 0-300. Most lenders set their minimum score at 160, but the SBA reportedly sets their minimum at 140.

Other Business Credit Bureaus

Small Business Financial Exchange (SBFE)

SBFE is a nonprofit association serving small-business lenders, including banks, credit unions, credit card issuers and other lenders that offer loans or extend credit to small businesses.The members provide your small business’s payment data to the SBFE, which then licenses the data to authorized SBFE-certified vendors, which include Dun & Bradstreet, Equifax, Experian and LexisNexis Risk Solutions. 9 out of the top 10 commercial lenders contribute data, 10/10 largest US business card issuers contribute data

- Business identification information, like your business’s name, address, DUNS number, NAICS code, and EIN.

- Positive payment information—bills you pay on time or early to lenders, suppliers, vendors, and business partners, plus your credit limits on those accounts

- Negative payment information—bills you pay late to lenders, suppliers, vendors, and business partners, plus your credit limits on those accounts

- Credit card payment history

- Payment information on your business’s lease payments

Credit Safe

CreditSafe is a business credit reporting agency offering comprehensive business credit reports in the US, and the UK.

The CreditSafe Risk Rating ranges from 1 to 100, where a score of 71 – 100 representing very low risk. This CreditSafe score predicts the likelihood that a company will become severely delinquent in their payment habits.

In addition, CreditSafe business credit reports include – average days beyond terms, a recommended credit limit, payment trends, inquiry trends, average business spend, and any tax liens and judgments filed in the last 6 years 9 months plus any bankruptcies filed in the last 9 years 9 months.

Ansonia

Ansonia credit reports include basic information on the company along with data on their payment experiences. Ansonia offers two scores: the credit rating and credit risk score. The Ansonia credit rating offers the business’s average purchases per month and approximate days-to-pay. The Ansonia credit risk score ranges from 0 – 100 with a score range of 70 – 95 reflecting a low-risk borrower.

Cortera

Started 25 years ago reporting commercial data on the Transportation industry, now they have expanded to serve a wide variety of businesses across many industries. Included in Cortera’s credit reports are 5 business credit scores/indexes which offer insights into a business’s purchase behavior, payment history, as well as general business events.

PayNet

PayNet is a business credit reporting agency with a database containing over 22 million contracts from small business loans, leases, and lines of credit. PayNet Business Credit History Reports include the PayNet MasterScore, which predicts a borrower’s risk based on 135 key variables that impact a business’s repayment performance. The PayNet MasterScore ranges from 450 – 800, where the lower the score, the higher the risk a borrow is deemed to be.

You cannot purchase PayNet business credit reports, the business must call and request a copy.

Credit.net

Credit.net operates in the US and Canada, reports business credit information on approximately 15.5 million businesses. Credit.net business credit reports encompass financial, reputation, and public record information on each business in their database. All this business data is used to generate Credit.net’s business credit score which ranges from 1 – 100. The higher a Credit.net business credit score, the better. If a Credit.net business credit report displays a business credit score of less than 70, then Credit.net does not have enough data to calculate a business credit score. Credit.net will also include a recommended credit limit for the business.

Trans Credit

TransCredit specializes in generating trucking industry credit reports. The transportation and trucking industry has very high barriers to entry due to how costly it is to remain front-and-center. Most trucking companies rely on business credit to fund operations, purchase a fleet, and/or factor invoices. TransCredit offers credit reports that are specific to this industry’s need’s. TransCredit’s Transportation Credit Score™ ranges from 0 to 100, where a score of 0 means that the company does not have enough information to generate a score. A low-risk borrower would have a score of 90 or above. TransCredit trucking industry credit reports also list the Overall Days to Pay™, which is the average number of days it took the trucking company to pay their invoices over the last 6 months

LexisNexis

LexisNexis® Small Business Credit Report combines credit data from the Small Business Financial Exchange, Inc. (SBFE) with Alternative Data from LexisNexis® to create a more inclusive snapshot of a small business.

National Association Of Credit Management (NACM)

NACM is the leading resource for credit and financial management, providing information, products and services for effective business credit and accounts receivable management to nearly 15,000 businesses and business credit professionals worldwide. This seems to be more of a membership option that surveys and creates indexes based off that data.

Tillful Business Credit Score

This is a newer business credit scoring system that works off the 0-100 model, similar to the major bureaus mentioned above. The Tillful Business Credit Score is based on real-time transaction data from bank and credit card accounts (as many as you want to link up through 3rd party API). They apply a machine learning based credit model to find patterns from cash flow data in order to accurately assess business credit scores. In addition to traditional factors, such as payment history, these cash flow patterns could include:

- Increasing or decreasing trend in your cash balance

- Irregularities in inflow and outflow

- Credit utilization trends

- Usage of overdraft facilities

- Payment delinquency

- And other factors

Business Credit Monitoring & Matching Engines

There are just two credit monitoring services that also offer a funding matching engine that I know of on the business side and that is Nav and Tillful. Nav offers you free access to your Experian Intelliscore℠ and Equifax Payment Index Score on the business side and your consumer Experian & Transunion Vantage credit score as well. Tillful is completely free and gives you access to your Tillful credit score. They both offer you access to a credit matching engine that will prequalify you for a range of business credit products. What I like is between the two of them they cover everything from SBA loans to Fintechs like Divvy!