I wanted to give you a cheat sheet for all of the credit score minimums I have found and notes for all the various revolving and non-revolving credit you can get. As with most pages here expect this to update over time.

Currently 67% of Americans have a “good” FICO score (670 or higher) and 62.5% of Americans have a “good” VantageScore. The average FICO score in the US is 716, and the average VantageScore credit score is 695, both of which are considered “good” credit scores.

In case you didn’t know the category breakdowns for prime ratings here they are.

| Category | Score Range |

|---|---|

| Super Prime | 781-850 |

| Prime | 661-780 |

| Nonprime | 601-660 |

| Subprime | 501-600 |

| Deep subprime | 300-500 |

We have another resource for basic credit scores and credit score ranges.

Mortgages

You typically need to have a credit score of 620 or higher to get a conventional mortgage, keep in mind that you can still get other types of mortgages with lower scores (eg: FHA loans start at 500 credit score)

Read more from the CFPB on subprime and FHA here

| FICO Score | APR | Monthly Payment (30yr fixed) | Monthly Payment (15yr fixed) |

|---|---|---|---|

| 760-850 | 3.191% | $1296 | $2099 |

| 700–759 | 3.413% | $1333 | $2132 |

| 680–699 | 3.590% | $1362 | $2158 |

| 660–679 | 3.804% | $1399 | $2190 |

| 640–659 | 4.234% | $1473 | $2254 |

| 620–639 | 4.780% | $1570 | $2338 |

Auto Loans

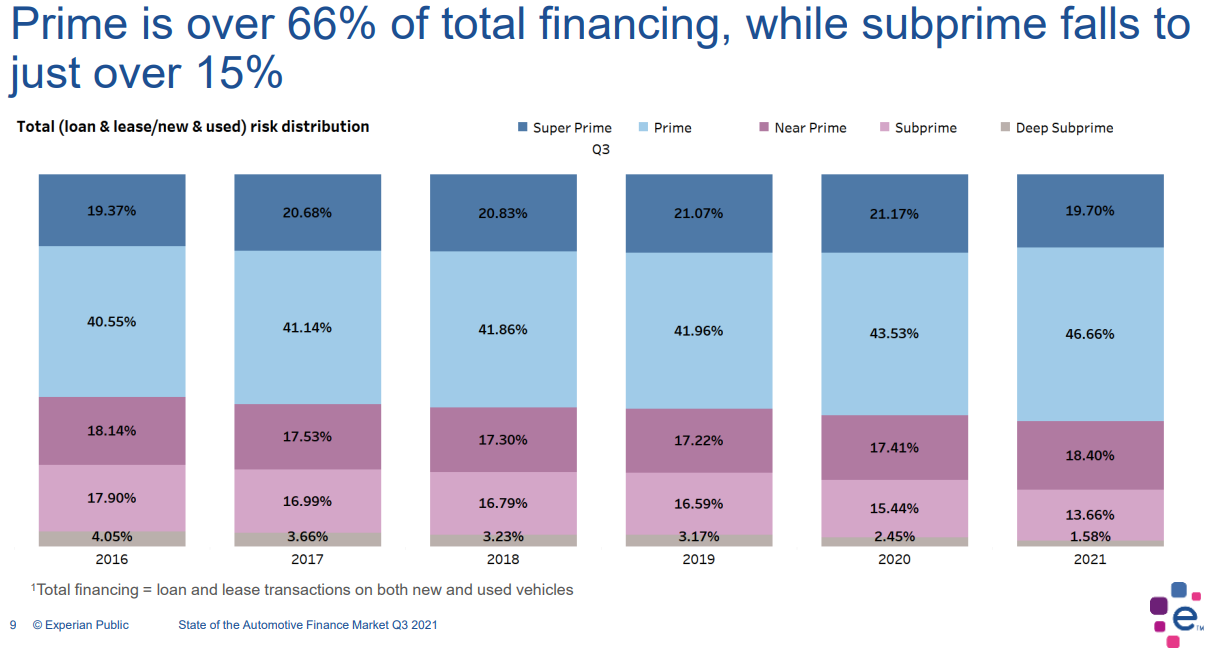

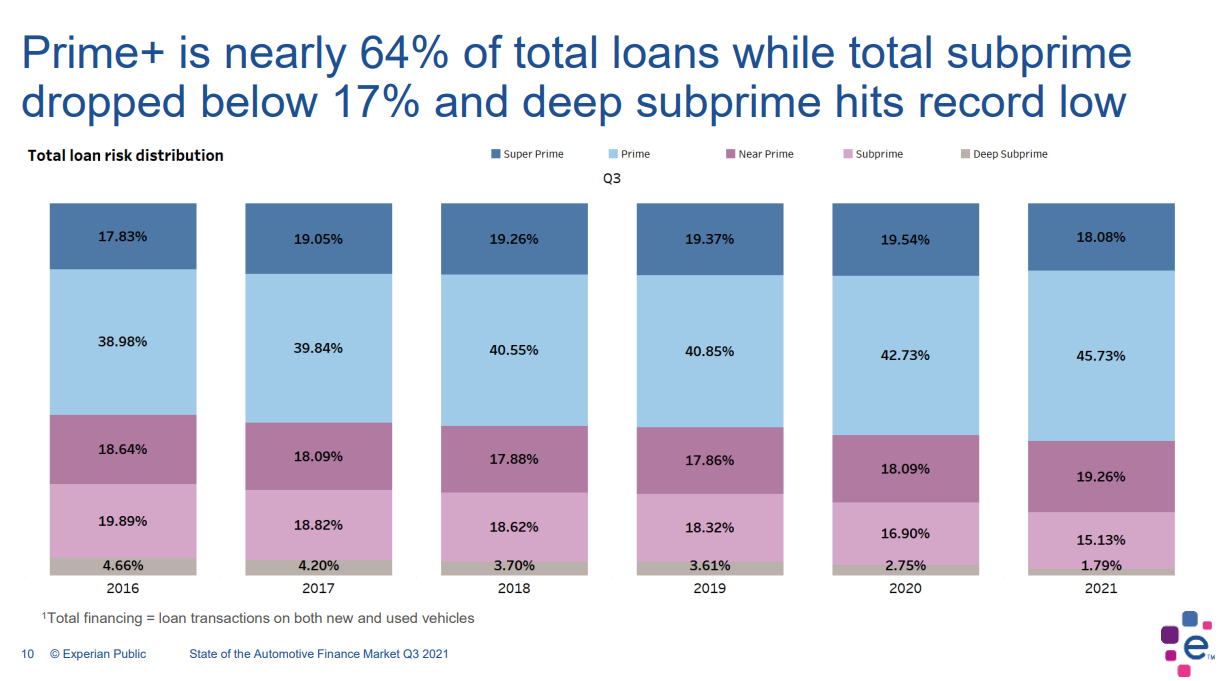

66% of people approved for car loans have a credit score of 661 or higher which is prime and super prime.

34% of people had a 501-660 and less than 2% had a score below 500.

The average APR for an auto loan on a new car is 7.09%, whereas the average APR on a used car is 10.91%

According to that same report on auto financing, the average interest rate for a non-prime borrower (300-660 credit score) for a new or used car is 12.46%, whereas the average APR given to prime borrowers (661-850 credit score) is just 3.82%.

That is 3 times the amount of APR!

| Credit Score | Loan Amount | Monthly Payment | New car APR | Used car APR |

|---|---|---|---|---|

| Deep subprime (300–500) | $29,952 | $587 | 12.99% | 19.85% |

| Subprime (501–600) | $35,092 | $631 | 9.92% | 15.91% |

| Near prime (601–660) | $39,310 | $642 | 6.32% | 9.77% |

| Prime (661–780) | $38,896 | $616 | 3.64% | 5.35% |

| Super prime (781–850) | $33,915 | $579 | 2.58% | 3.68% |

Lenders will use your credit score/prime rating to determine not only the APR you get but also the loan length aka term your loan will be. They do this because the lower the score and rating the higher risk you are considered in their eyes.

Credit Cards

As with any type of credit product a lower score will get you lower limits, higher APRs and you will probably NOT get any sort of SUB (sign up bonus). Your accounts in the below prime categories will get less CLIs and be at higher risk of decreased CL and account closure.

I want to share a lot more data here to drive home the point, its not so simple of this score will get you this card etc. By you looking over the data below you will see the patterns, so depending on what group your credit score falls into, you can set better expectations.

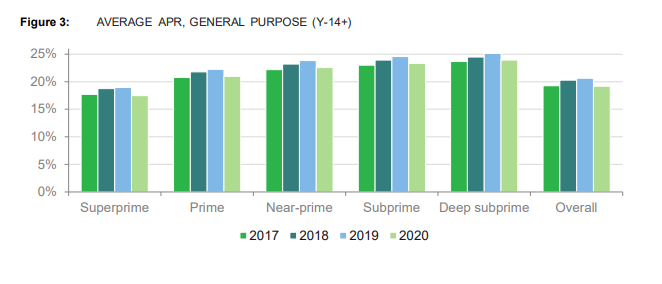

| Year | Superprime | Prime | Near-prime | Subprime | Deep subprime | Overall |

|---|---|---|---|---|---|---|

| 2017 | 17.7% | 20.8% | 22.2% | 23% | 23.7% | 19.3% |

| 2018 | 18.8% | 21.8% | 23.3% | 23.9% | 24.5% | 20.3% |

| 2019 | 18.9% | 22.2% | 23.8% | 24.6% | 25.1% | 20.6% |

| 2020 | 17.5% | 21% | 22.6% | 23.3% | 23.9% | 19.2% |

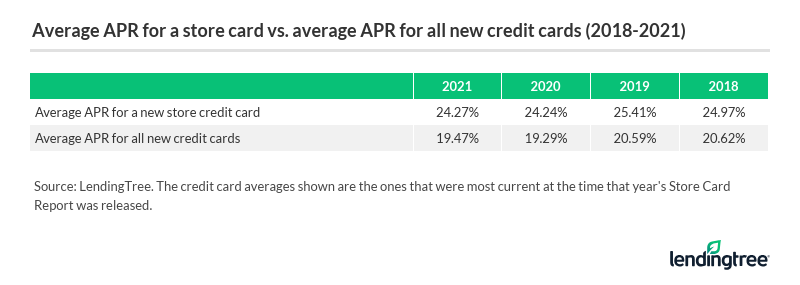

Here is a quick look at store credit card APRs, up to 2021.

Average Credit Line On New Accounts

| Year | Superprime | Prime | Near-prime | Subprime | Deep subprime |

|---|---|---|---|---|---|

| 2020 | $8,000 | $4,000 | $2,000 | $500 | $200 |

The median CLI in 2020 was $1500 compared to $2,000 in 2019. The biggest drop was in the prime category during 2020 the median CLI dropped from $1550 to $1,000.

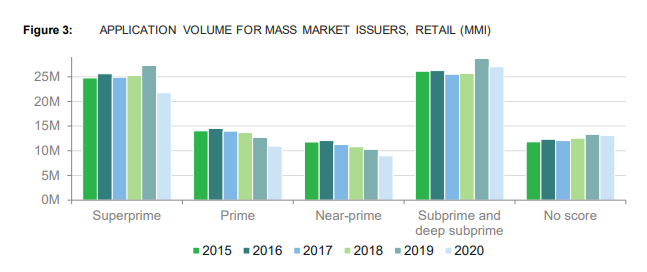

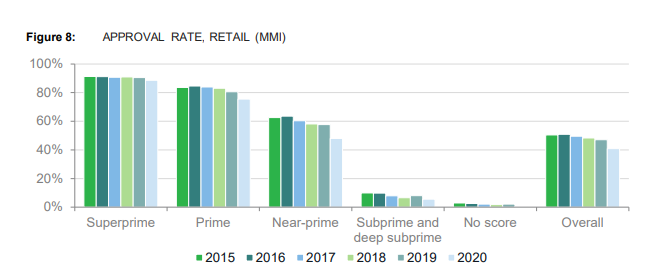

Application Volume & Approvals

In short, subprime and deep subprime apply more often and get less approvals, while prime apply less and get more approvals. Super prime is applying a lot and getting a high approval rate.

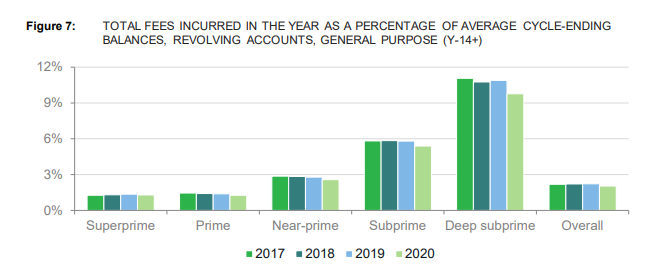

Fees

Look at the chart below you will see subprime and deep subprime, overpaying in fees as well. This is late fees, annual fees, balance transfer fees, cash advance fees, debt suspension fees and other. Understand 99% sits in late fees!

Overall the data is showing that for the most part credit card APRs are going down from 2019 (20.6% ) to 2020 (19.2%). Keep in mind that below prime can still expect to pay upwards of 29% APR on your CreditOne, Capitalone and similar deep subprime cards.

Personal Loans

Personal loans is a little bit different as you can put up collateral or secure a loan if you fell into the subprime or deep subprime.

| Lender | Best For | Min. Credit Score | Bureau They Pull | Est. APR | Min Loan | Max Loan |

|---|---|---|---|---|---|---|

| Avant | Range of repayment options | 580 FICO 550 Vantage | Webbank-Experian | 9.95%-35.99% | $2,000 | $35,000 |

| Lending Club | Marketplace size | 600 | Transunion | 7.04%–35.89% | $1,000 | $40,000 |

| Onemain Financial | Secured Loans | 620+ | Experian | 18%–35.99% | $1,500 | $20,000 |

| Upgrade | Fast funding | 620+ | Transunion | 5.94%–35.97% (with autopay) | $1,000 | $50,000 |

| Upstart | Limited credit history | 600 | Transunion FICO 9 | 6.76%–35.99% | $1,000 | $50,000 |

Here is more personal loan data and soft pull pre-qual personal loan offers .