This will be a dedicated guide to Capital One credit cards that I hope will be one of the only stops you have to make in getting all the information you need in order to get your very first or additional Capital One cards.

Capital One credit cards are a pretty mixed bag in terms of people’s opinion them, I think this is natural when covering such a wide range from credit repair based cards all the way to lets say “regular cards”. In this guide we will cover both sides of Capital one, so we will cover everything we know at this point with what bureau Capital One pulls from, the credit scores they like to see, how to get additional cards and of course CLIs!

Be sure to bookmark this page as we will constantly be updating it as information changes!

Capital One Data Points

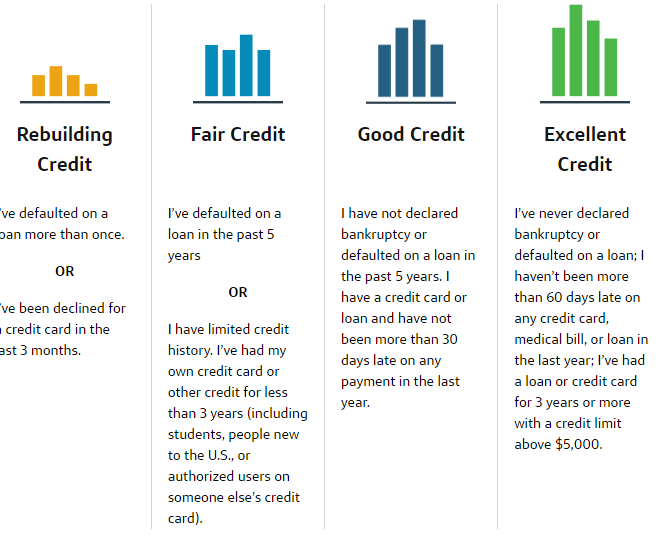

Hard Pull (hard hit) on ALL 3 BUREAUS & 680+ credit score on regular cards like Venture and 580+ on credit rebuilding cards like the Quicksilver and Platinum cards. I believe they are in fact the ONLY credit card company that pulls a credit report from all 3 credit bureaus, this for many consumers is a huge turn off!

During normal times (non-corona) Capital One likes to see a 680+ credit score on their regular cards and a 580+ on the credit rebuilding cards. I have seen many people getting the credit rebuilding cards with a variety of data points from 500 credit scores (no derogs, good history, thin file) to my own which was in the 560s at the time when I got my first Capital One Quicksilver card (2010 BK, multiple lates/write offs)

Keep in mind with the credit rebuilding cards you will probably only get approved for $300-500, both of mine were approved for $400 originally and then they automatically have a $100 CLI that happens after 5 or 6 on time payments.

Here is a backdoor link to upgrading your Platinum and Quicksilver One cards to Quicksilver cards which will get you the 1.5% cashback. *its odd how it works, it will force login regardless if you already logged in and if there no cards valid to upgrade it will say no cards available to upgrade or link/offer no longer available. Assume its because you have no cards ready to upgrade. Keep in mind there is NO hard hit for this upgrade!

Getting CLIs (credit limit increases)

Capital One works on a 6 month rule, meaning every 6 months you can request a CLI, I have also heard talk of a 7/24 rule as well which is no more than 7 inquires over the last 24 months which a lot of banks even thought may never mention it, do in fact follow.

Capital One actually makes it pretty clear even on their website FAQs what they are looking for in order to approve a CLI. More on that in a sec…

To actually request a CLI, its really easy, you will see it in your account under “I want to…” section/button. You will see a “Request Credit Limit Increase” option. Simply fill out the form and submit. If you are approved you should get notification right away that you were approved. If you get the 5-7 day letter notification it most likely means no and if you recently already got a CLI then you will get a message saying you don’t qualify at this time because you recently got a CLI already.

They work like most banks in that first off they want to see you using the card, I know with some people they get into the hoarding side of cards and accounts just to see if they can get it but similar to Citibank and Discover, they want to see you active. Also they don’t say it directly but they want you to pay more than the amount due, which I think ALL credit card companies want to see but when it comes to CLIs, its a pretty important factor to Capital One.

I know this because not only does it list this as a reason you might be denied but also too because I was denied on a CLI after my credit rebuilding cards matured and the reason why is I still wasn’t paying enough per month. Keep in mind at the time I was making $100 monthly payments on $600 credit limit cards with less than 30% utilization.

Keep in mind that Capital One is known for sandboxing customers, meaning that those who start with lower limits never get to fully experience great CLs with them because they box them off into low limit category and some users can just never break out of that. The variables for how this works aren’t known by the public, there are thousands of stories in the FICO forums over the years to support this.

Getting Additional Capital One Credit Cards

This process is actually pretty easy, there is no special offers in your account admin or special process here, you would simply use the non-impact pre-approval page here to see if you qualify for another card. I did personally setup multiple cards through Capital One even though I probably wouldn’t do that again or suggest to do it.

Having multiple cards with Capital One is pretty easy to manage, each account is accessible from the same login/admin and easy to navigate between each one for account management all the way down to requesting CLIs.

Rebuilding Credit With Capital One

These are some of the easiest cards to get, that being said they come at a heavy price, hitting all three credit bureaus with an inquiry that WILL stay on for full 24 months isn’t something you should take lightly. If you are rebuilding your credit or building your credit for the first time then the Quicksilver One and Platinum cards are the best intro cards they offer, much better than the likes of a Credit One card. I would argue there is much better options for people with no credit and even rebuilding a secured credit card will go a long way.

The easiest way to see if you qualify is to check their own pre-approval page here, and I would also suggest to cross reference that with the suggestion engines on Credit Karma, Wallet Hub and Experian to see if you are also showing good/excellent approval odds on those sites as well.

The cards Capital One offers for rebuilding credit or even Fair credit usually start off with lower limits ($300-$500) and you have to pay 5 monthly payments in a row and then on the 6th or just after you get bumped up $100-$200 CL. From there depending on how you used that card you are either going to be bucketed (tagged and can’t get CLIs) or in great shape to either upgrade or get a CLI.

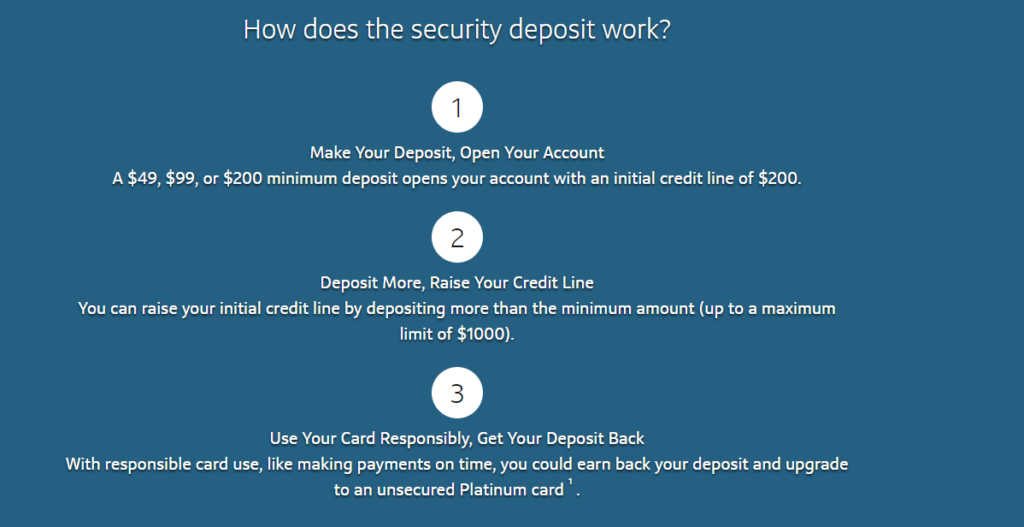

Capital One also offers two secured credit cards…

There is a lot of talk about how long the secured credit cards take to graduate and many doubt they do graduate but given what we know of Capital One, you can assume they start to offer a higher CL after 6 months (yes that means you will have to deposit more money) and at that point you could technically get approved for unsecured graduation. From everything we have researched, this however almost never happens! Instead you can expect the secured cards to graduate somewhere between 12-18 months (if at all), because they even tell you on the site that not everyone will graduate.

Similar to other banks, Cap 1 wants you to use your card each month and then pay it down to no/very low balances at the end of the month, this is especially true on the credit builders. The formula they use I feel is one of the harder systems to figure out because it seems pretty random who gets CLIs and who gets bucketed.

Capital One Internal Credit Score

Capital One makes it pretty easy to see what cards you should be focused on based on their own credit level ratings system they use on the credit card compare page. Have a look…

Capital One Personal Credit Cards

Capital One has 24 personal credit cards and all of them tell you which internal score requirement they have, you can filter by that and other metrics below.

The SUBs (signup bonus) always change, we will do our best to keep this updated.

| Credit card | Signup Bonus | Regular APR | Cashback | Annual Fee | Datapoints | |

|---|---|---|---|---|---|---|

|

Venture X Rewards | 100,000 bonus miles | 16.99% – 23.99% | 10x miles on hotels, rental cars 5x miles on flights 2x miles all other |

$395 | Excellent |

|

Venture Rewards | 60,000 bonus miles | 15.99% – 23.99% | 5 miles per $1 on hotels, rental cars 2 miles per $1 unlimited |

$95 | Excellent 680+ $20,000 with 2 AU’s over $10,000 each |

|

VentureOne Rewards | 20,000 bonus miles | 0% intro APR for 15 months; 14.99% – 24.99% variable APR after that | 5 miles per $1 on hotels, rental cars 1.25 miles per $1 unlimited |

$0 | Excellent |

|

VentureOne Rewards -Good Credit | 26.99% | 1.25 miles per $1 unlimited | Good | ||

|

Quicksilver Rewards | $200 CB | 0% intro APR for 15 months; 14.99% – 24.99% variable APR after that | 1.5% unlimited | $0 | Excellent 650s/ $500 |

|

Quicksilver Rewards- Good Credit | 26.99% | 1.5% unlimited | $0 | Good | |

|

Savor Rewards | $300 CB | 15.99% – 23.99% | 4% on dining, entertainment, popular streaming services 3% on grocery 1% on other purchases |

$95 | Excellent |

|

SavorOne Rewards | $200 CB | 0% intro APR for 15 months; 14.99% – 24.99% variable APR after that | 3% on dining, entertainment, popular streaming services, grocery 1% on other purchases |

$0 | Excellent |

|

SavorOne Rewards- Good Credit | 26.99% | 3% on dining, entertainment, popular streaming services, grocery 1% on other purchases |

$0 | Good | |

|

Quicksilver One Rewards | 26.99% | 1.5% unlimited | $39 | Fair 560s/ $400 |

|

|

SavorOne Rewards for Students | 26.99% | 3% on dining, entertainment, popular streaming services, grocery 1% on other purchases |

$0 | Fair | |

|

Quicksilver Rewards for Students | 26.99% | 1.5% unlimited | $0 | Fair | |

|

Journey Student Rewards | 26.99% | 1% on purchases 1.25% when pay on time |

$0 | Fair | |

|

Platinum Mastercard | 26.99% | $0 | Fair 560s/ $300 |

||

|

Quicksilver Secured Rewards | 26.99% | 1.5% unlimited, $200 min deposit |

$0 | Fair | |

|

Platinum Secured | 26.99% | Refundable deposit of $49, $99 or $200 gets you a $200 initial CL | $0 | Rebuilding Graduates 6-18 months |

|

|

Capital One Walmart Rewards Mastercard | 5% CB in store | 17.99% – 26.99% | 5% on walmart.com, walmart app 2% on purchase in store, Murphy USA gas stations 2% on restaurant, travel purchases 1% on other purchases |

$0 | Good-Excellent |

|

Pottery Barn Key Rewards Visa | 24.99% | 5% across seven brands: Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Williams Sonoma, Williams Sonoma Home, West Elm, and Mark & Graham | $0 | Excellent | |

|

Williams Sonoma Key Rewards Visa | 24.99% | 5% across seven brands: Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Williams Sonoma, Williams Sonoma Home, West Elm, and Mark & Graham | $0 | Excellent | |

|

West Elm Key Rewards Visa | 24.99% | 5% across seven brands: Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Williams Sonoma, Williams Sonoma Home, West Elm, and Mark & Graham | $0 | Excellent | |

|

The Key Rewards Visa | 24.99% | 5% across seven brands: Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Williams Sonoma, Williams Sonoma Home, West Elm, and Mark & Graham | $0 | Excellent | |

|

Cabela’s Club Card | 1% in CLUB points | 9.99% APR on Cabela’s and Bass Pro Shops purchases; 15.24% – 26.99% variable APR on all other purchases | 2% CLUB points on Bass Pro Shops, Cabela’s purchase | $0 | Excellent |

|

Bass Pro Shops Club Card | 1% in CLUB points | 9.99% APR on Bass Pro Shops and Cabela’s purchases; 15.24% – 26.99% variable APR on all other purchases | 2% CLUB points on Bass Pro Shops, Cabela’s purchase | $0 | Excellent |

Capital One Business Credit Cards

Capital One business currently offers 6 credit cards, ranging in score requirements again based off the internal scoring we covered above.

This is where I have to dog on Capital One quite a bit here, I found this out the hard way which is that the business credit cards get reported to your personal credit profile as well. This is weird because a business credit card works much differently in terms of the billing terms and acceptable balances, yet Capital One is reporting that to your personal file so when you max out your business credit card, which actually is pretty normal even for a small business, its reporting as maxed out on your personal profile. This will completely destroy your credit score as it will send your credit utilization through the roof!

It gets worse, lets say you have a 0% interest card with a $30k limit on it and you maxed it out at year end spending, that utilization will show up on your personal profile and would tank your credit score right around the holidays and new year! I have heard of drops as high as 150 points, even if you have 800+ score.

2021 Update: If you opened a Capital One Spark Cash Plus for business card on or after October 20, 2020, Capital One will NOT report all activity to personal credit bureaus- just negative activity. All other Capital One Spark for Business cards report ALL activity to your personal credit.

| Credit card | Signup Bonus | Regular APR | Cashback | Annual Fee | Datapoints | |

|---|---|---|---|---|---|---|

|

Spark Cash Plus | $1,000 CB; $500 once you spend $5,000 in the first 3 months, and $500 once you spend $50k in the first 6 months | No APR since your balance is due in full every month | 2% unlimited | $150 | Excellent 670+ |

|

Spark Cash Select- Excellent credit | $500 CB | 13.24% – 19.24% | 1.5% unlimited | $0 | Excellent 670+ |

|

Spark Cash Select- Good Credit | 0% intro APR for 12 months; 15.99% – 23.99% variable APR after that | 1.5% unlimited | $0 | Good 670+ |

|

|

Spark Classic | 26.99% | $0 | Fair 688/ $500 |

||

|

Spark Miles | 50,000 bonus miles | 20.99% | Unlimited 2x miles per $1 | $0 intro for the first year, $95 after that | Excellent 670+ |

|

Spark Miles Select | 20,000 bonus miles | 0% intro APR for 9 months; 13.99% – 23.99% variable APR after that | Unlimited 1.5x miles | $0 | Excellent 670+ |

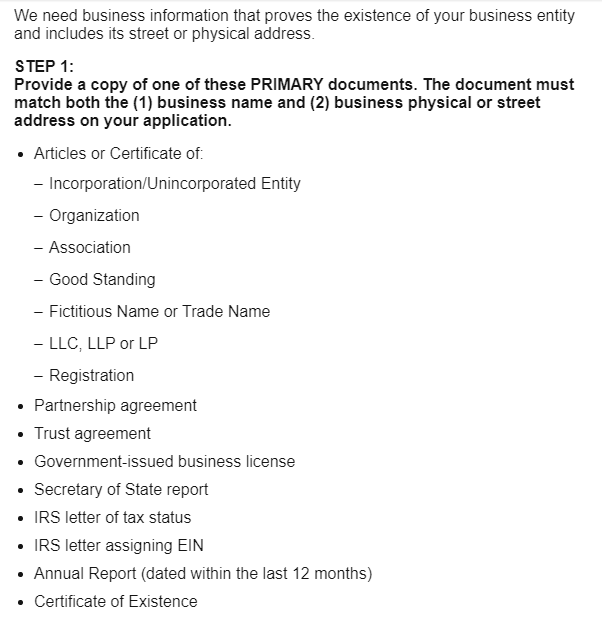

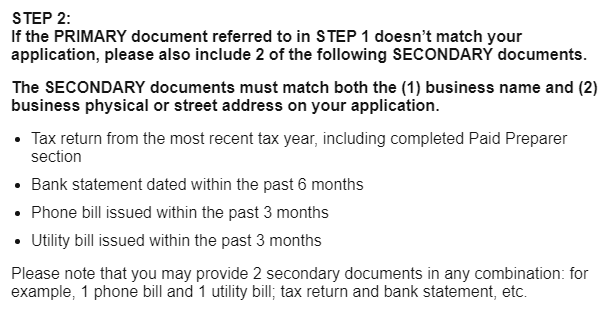

2021 Capital One Business Credit Card Updates

We have fresh intel for you on the submission process of the Cap 1 Spark business card, here is the standard data they are requesting for new applications. They state in the email that this is based on new requirements from the government.

Capital One Phone Numbers

These are what we call back door phone numbers, or numbers you can call for recon or other needs in the approval and CLI front.

Cap1: 800-625-7866 (Account Specialist)

Cap1: 800-951-6951 (cust. relations)

Cap1: 800-903-9177 (Application Service Group department)

Cap1: 800-548-4593 (application status – automated only)

Cap1: 800-955-7070 (App Status) Select App for New then Option 2 to check App status

Cap1: 800-889-9939 or 800-625-7866.(Account Specialist)

Cap1: 877-513-9959 (Account Retention?)

Cap1: 800-258-9319 (Debt Recovery)

Cap1 Secured Platinum: 800-219-7931 (deposit taker, can speak to credit analyst)

Cap 1: 800-707-0489 (Senior Escalation Account Mgrs.)