We have been keeping you up to date with credit standards across consumer loans and mortgage loans during the Covid-19 pandemic and it would appear as though some things have changed. According to the latest FED senior loan officer survey, just as inflation is taking ahold of most sectors from groceries to steel, we have credit standards loosening up in a huge way making it almost impossible not to get a loan or mortgage.

Commercial & Industrial Loans (C&I) & Commercial RE (CRE)

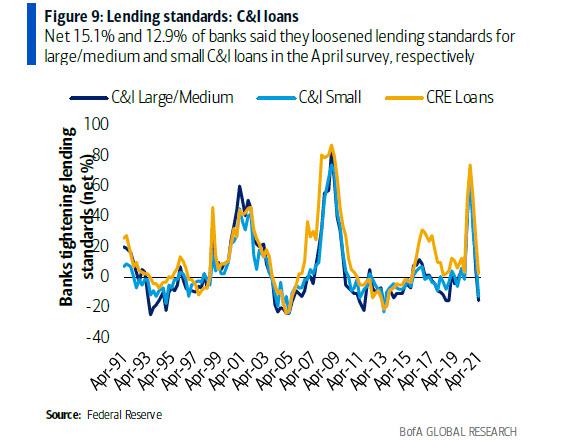

Net 15.1% and 12.9% of banks said they loosened lending standards for large/medium and small C&I (commercial & industrial) loans in the April survey, respectively, after net 5.5% and 11.4% of banks reported tightening lending standards in the prior January survey. As a result, lending standards for C&I loans are now the easiest they have been in years. Meanwhile, the share reporting tighter standards for CRE loans declined to 2.5% in April from 25.4% in January (the CRE value reported is the average for the three separate questions on loans for construction and land development (tighter standards), loans secured by nonfarm nonresidential structures (unchanged standards), and loans secured by multifamily residential structures (looser standards).

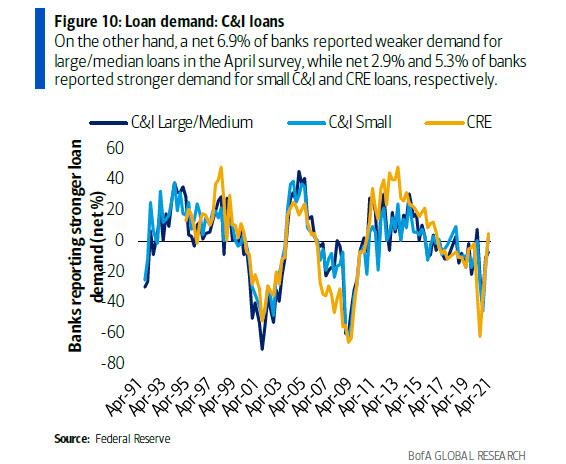

On the other hand, a net 6.9% of banks reported weaker demand for large/median C&I loans in the April survey, while net 2.9% and 5.3% of banks reported stronger demand for small C&I and CRE loans, respectively. This follows net 11.1%, 17.6% and 14.2% of banks reporting weaker demand for large/median C&I, small C&I and CRE loans in the prior January survey, respectively (Figure 9).

Mortgages

With much of the US housing market seeming in a huge bubble, from insane rates in San Fran to mid-Texas, it would appear that though not only is there a mad scrabble to leave certain states, but also with higher costs of building, just overall a more expensive house. A net 6.3% and 19.0% of banks reported looser lending standards for GSE-eligible and QM-jumbo mortgages in April, respectively, up from net 3.2% and 1.7% in the prior January survey. As shown in the chart below, this is on par with the loosest resi mortgage credit standards since before the financial crisis! The net share of banks reporting stronger demand increased to 12.7% and 19.7% in April from 6.5% and 6.6% in January, respectively. Rates have been some of the lowest in a very long time, people were flocking to refi and grab up additional houses.

Consumer Loans

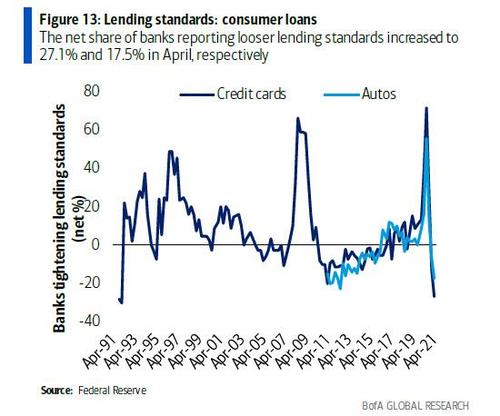

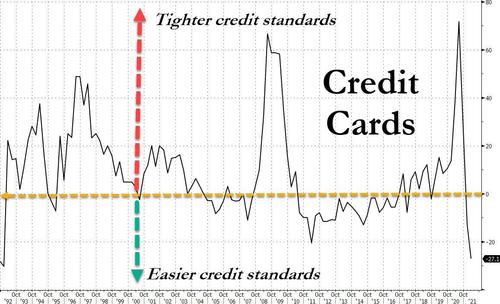

Net share of banks reporting looser lending standards increased to 27.1% and 17.5% in April from 12.8% and 7.0% in January for credit card and auto loans, respectively. As shown below, credit card standards have not been this loose since around the time records began in 1991, while auto loans are similarly among the loosest on record. This means that anyone that can fog a mirror is now eligible for a credit card! Yet I know many who still aren’t getting CLIs or even credit cards. Strange right?

Here is another look at just ho big of a gap things have swung here over the last 12 or so months

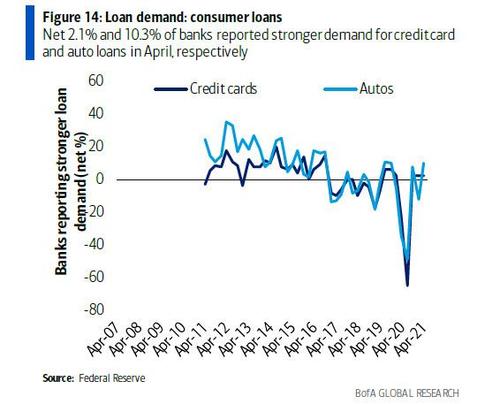

We see similar numbers on auto loans with a net 2.1% and 10.3% of banks reported stronger demand for credit card and auto loans in April, respectively, following net 2.2% of banks reporting stronger credit card demand and net 12.3% reporting weaker auto loan demand in January.

This is how the credit game goes, rewind a year when people really needed the breathing room and couldn’t get it, now when the economy is opening back up and stimulus printing is at an all time high, they loosen up all the credit standards again. This is something I was warning about back in 2019, get your credit cards and loans while you can because you never know. Little did I know that next we would see a global pandemic, the point remains to get while the getting is good.