As of April 30th the average 30-year mortgage was just 3.23%, down from 3.33% the week before, which is the lowest rate in almost 50 years of database keeping, according to Freddie Mac.

On the same day data company Redfin published some data points from last week, here are the highlights.

- Home-buying demand is making a speedy recovery, down only 15% from pre-pandemic levels

- Buyers are nervous, but continue to pay up. Prices are up 1% compared to last year and affordable homes are selling like hotcakes

- New listings are up from their low-point on April 13, but can’t keep up with home-buying demand. There are fewer than 700,000 homes for sale in Redfin markets; a five-year low

- Mortgages rates are low, but credit is still tight. Lenders are demanding big down payments, especially for high-end homes, forcing some buyers to put their purchases on hold

- For the 7-days ending April 24th, median listing price for a home was $308,000, which as mentioned above is up 1% y-o-y.

Home-buying is back on the rise, gaining steam for the third straight week, after plummeting 34% in March, now down just 15% from the pre-coronavirus levels. That mixed with a 5-year low in inventory (just 700,000 homes) is fueling a nice rebound.

“The ten largest states had increases in purchase activity, which is potentially a sign of the start of an upturn in the pandemic-delayed spring home-buying season, as coronavirus lockdown restrictions slowly ease in various markets,” Joel Kan, MBA’s associate vice president of economic and industry forecasting, said in a statement. “California and Washington continued to show increases in purchase activity, with New York seeing a significant gain after declines in five of the last six weeks.”

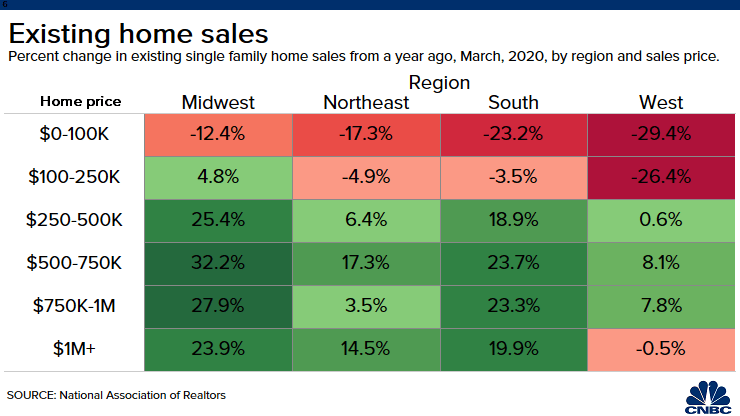

If you remember home sales took a big dip back in March as the shutdown kicked in right in the midst of the normally busy spring market.

Signed contracts on existing homes fell 20.8%, according to the National Association of Realtors.

Regionally, pending sales fell 14.5% in the Northeast for the month and were 11% lower than a year ago. In the Midwest, sales decreased 22% monthly and 12.4% annually. In the South sales dropped 19.5% for the week and 17.8% annually, and in the West they fell 26.8% weekly and 21.5% compared with a year ago.

Should You Refinance?

With the rates hitting 50 year lows, that brings up a very valid question which is “should you refinance your mortgage?” First off don’t get too excited yet, even Fannie May is forecasting rates will go lower and could dip to below 3% for the first time ever in 2021.

Here are some simple questions to ask yourself and go through before you jump on a refi!

How old is your current mortgage? If older than 5 years and especially if you have been paying more to knock down interest then I would really look at if its worth it.

What is your current mortgage rate? If its within 1% and you have been paying for over 5 years, probably not worth it but less than 2 years than probably is worth it.

The biggest factor to remember is that a refinance comes with closing costs again and most importantly it restarts a brand new amortization schedule, where the first 7yrs are front end loaded with interest NOT principle. If you’re unaware of what I am talking about, an amortization schedule is your payment breakdown and 99% of the time the first few years you’re paying mostly interest, which does NOT help you pay down your house. I will be writing a more indepth guide on mortgages soon!

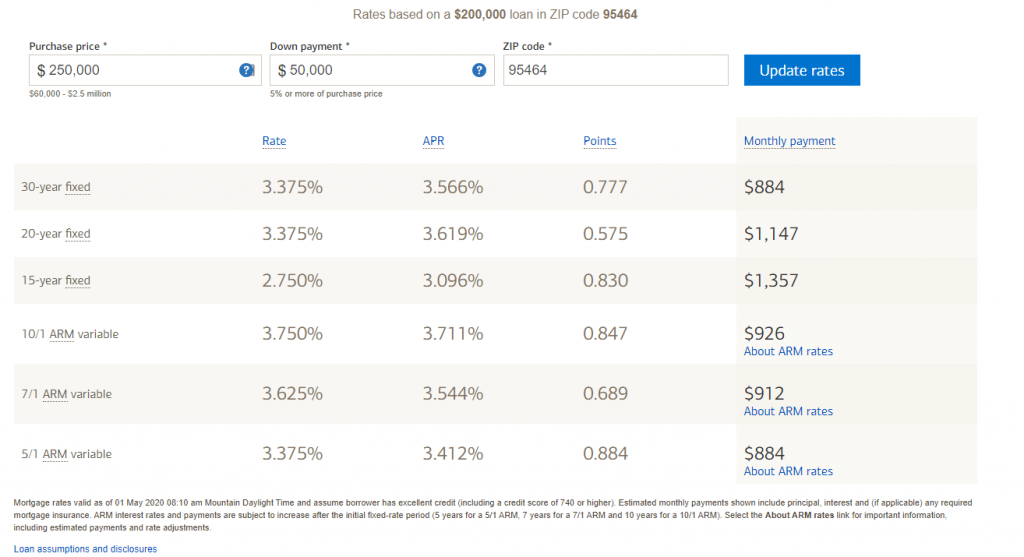

Here are mortgage rates at Bank Of America- as you can see the national average doesn’t mean everyone will have that rate or that everyone will qualify for that rate!

You can also check out mortgage rates at Wells Fargo here!

![Chase Credit Card Review [Complete 2024 Guide]](https://walletmonkey.io/wp-content/uploads/2024/10/Chase-Credit-Card-Review-blog-post-300x169.png)