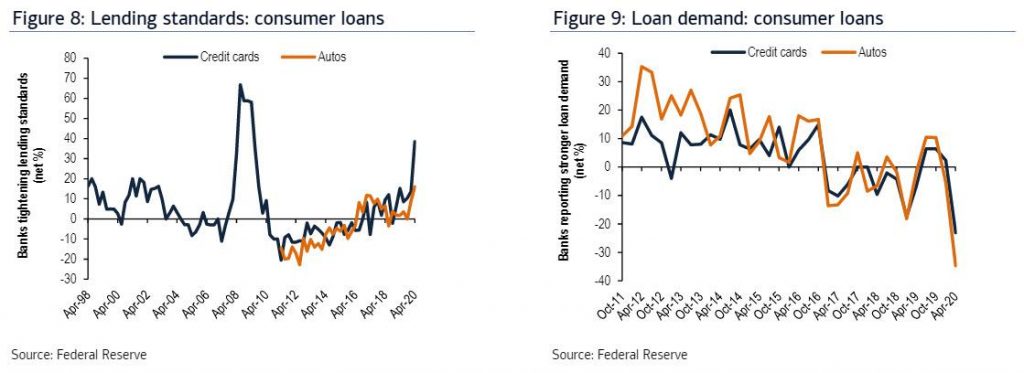

I have been keeping a tight eye on consumer debt stats and been reporting the increased standards from lenders, we are just now starting to get more data on how much personal debt numbers have gone up which isn’t as bad as I would’ve thought but I don’t think this is completely up-to-date either.

Household debt balances through March totaled $14.3 trillion, a 1.1% increase from previous quarter and now $1.6 trillion clear of the previous nominal high of $12.7 trillion from Q3 of 2008 GFC. That being said, credit card balances fell $34 billion, which helped offset a $27 billion increase in student loans and $15 billion in auto debt. Mortgage balances rose $156 billion to $9.71 trillion.

This credit card decrease comes on top the fact that credit limits increased by $34 billion.

“The credit card balance decline was notably larger than the same period last year, which may reflect the early signs of decreased consumer spending due to COVID-19,” the New York Fed said in a release.

Student loan debt now totals $1.54 trillion, 10.8% of that was 90 days or more delinquent. Overall delinquency ticked down to a 4.6% rate.

If you ask me, this doesn’t look bad at all YET! Finger on the pulse.