The current US economy that has been created from the Covid-19 is a strange one to say the least. You are hearing stories ranging from people not wanting to go back to work because they are literally making more money from unemployment perks vs working and then you have millions who are calling up credit-card companies to skip payments. It’s so strange to see. I can’t figure out if its just that millions are that dumb that they don’t know there are so many programs out there (submit the EIDL grant for their side hustle and every single LLC/entity they have, file for $1200 stimulus, $500 dependent on each child and then also file for unemployment) or if the systems are just rejecting that many people across so many programs.

I am reading first hand stories on both sides of this thing and again unclear on what the causes are here, but you can’t say there isn’t enough money floating around out there for those who are taking fast action. In times like this it will always come down to acting fast, the EIDLs were/are first come, first serve, the $1200 stimulus deadline has passed, you have till May 5th (I believe) to submit for $500 dependents, you can still file for $600 per week unemployment, the EIDL just got refilled and the portal here is about to be activated again (expecting today or tomorrow).

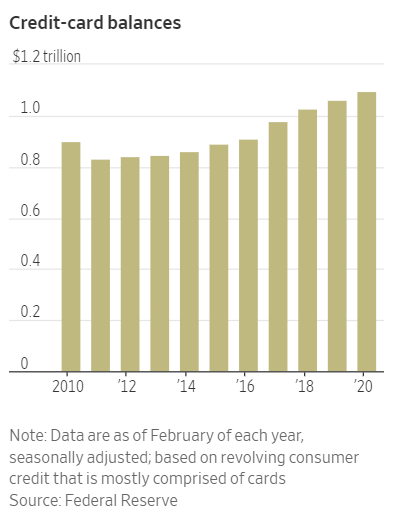

As the economy spirals, credit-card payments is the first thing people drop and stop paying, this is especially true for store cards like the 131 store cards Synchrony Financial backs.

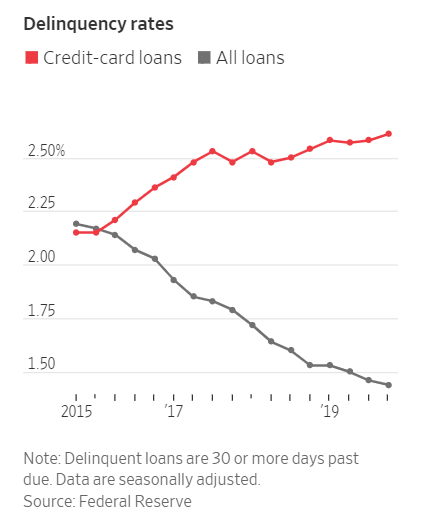

Capital One, Discover Financial and Synchrony Financial are all working with their clients to pause credit-card payments for a month or two, waiving late fees and interest charges and in some cases (really small balances of $50 or less) Synchrony is forgiving balances. That being said, credit analysts are expecting delinquencies and charge-offs to soar later this year!

The stock share price of both Discover and Synchrony have lost more than half their value so far in 2020. That is much worse than the broader market, which has declined about 12% so far. This is driving these banks to not only tighten up on new credit card applications, but also review current customers and decrease balances on old accounts that aren’t being used and even close accounts.

Discover and Synchrony said this week that they have allowed hundreds of thousands of borrowers to defer their payments, including many credit-card customers. Capital One, which has roughly 120 million credit-card accounts in the U.S., according to the Nilson Report, said it enrolled 1% of its active card accounts into deferral programs. The three banks are a good gauge of the financial health of a swath of American consumers. Discover and Synchrony generally don’t market to affluent customers, and Capital One has a large number of customers with less-than-pristine credit scores.

Now on the other end of the scale card issuers like American Express are also tightening their standards on new credit cards and returning to their former glory of quietly requiring a 750 FICO or higher, so the days of 660-720 scores getting approved are over!

“For the next two years or so until everything settles, [credit cards] will be much less profitable and more risky,”

Brian Riley, director of credit advisory services at Mercator Advisory Group.

“We clearly have already had significant deterioration,”

“This was very quick and cataclysmic.”

Roger Hochschild, Discover’s chief executive

As I reported last week, this whole event will lead to millions of Americans who face derogatory marks on their credit profiles from mortgage forbearance, skipped payments and opting to not pay credit-cards and NOT calling them to make arrangements. If you’re struggling with credit-card payments, the best thing to do is always CALL THEM!