I have been waiting on data from the big subprime car lenders like Credit Acceptance Corp and I found some the other day. Credit Acceptance said in a regulatory filing on Monday April 20th that they will need more time to publish its quarterly report.

“A continued disruption in our workforce, decrease in collections from our consumers or decline in consumer loan assignments could cause a material adverse effect on our financial position, liquidity and results of operations,” Credit Acceptance wrote.

Ally Financial Inc also reported on April 20th that about 25% of its auto-loan customers have taken advantage of its payment-deferral program (important to note that Ally stated most of these people have never been delinquent before)

Of the 1.1 million borrowers who requested forbearance, more than 3/4 have never asked for deferral before and 70% of them never had a late payment with Ally. This is actually a positive considering the millions who can’t pay their credit-cards we reported yesterday and the now 26.5 million people unemployed.

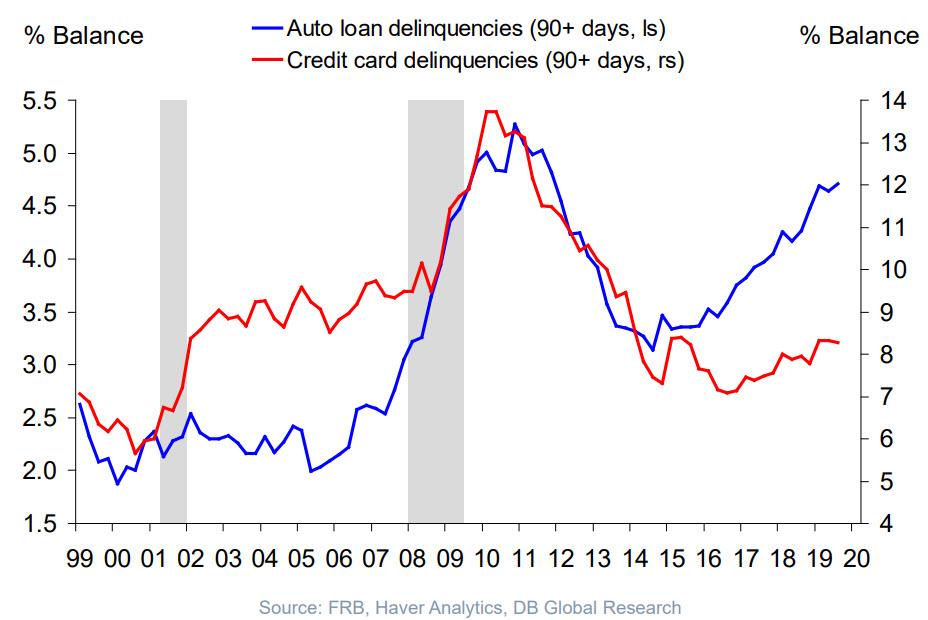

Here is a look at the most recent auto-loan delinquency rate, which was taken around end of 2019.

The St. Louis Fed just released some of their own research covering which demographics they see most widely affected by the Covid-19 crisis and sectors they feel could take a 75% hit!