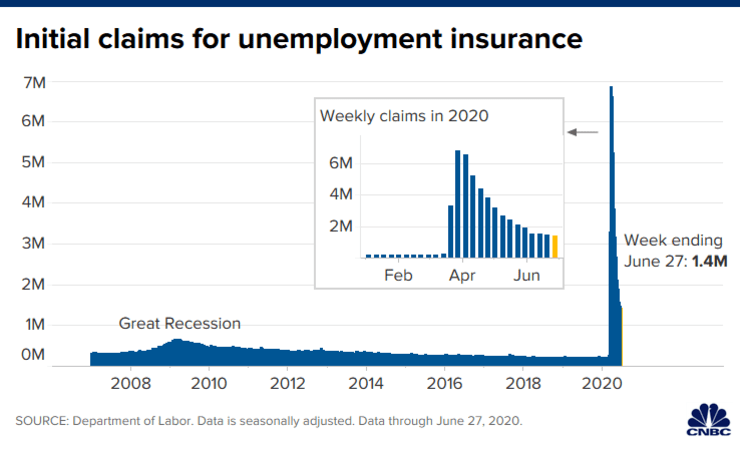

Its been a month or so since we looked at the jobless numbers and where the economic data sits right now so lets check in with that. Initial jobless claims hit all time highs at various points during this whole pandemic, the worst of it hit in mid-April and into May, June and July you can see its calmed down a bit.

As of right now there is somewhere around 25 million unemployed Americans.

Just because we are hearing about positive job numbers doesn’t actually mean all is ok, in fact so far 9,274 stores have closed down according to Forbes and Coresight CEO Deborah Weinswig is estimating if “anchor” mall tenants fall, we could see upwards of 25,000 businesses close this year (compared to 9,302 store closings in 2019)

While we are seeing retail continue to purge, we also saw a new problem emerge which was that 63% of jobless workers are making more on unemployment than when they were working! This was according to data on 61,000 households who received unemployment benefits between March and May 2020.

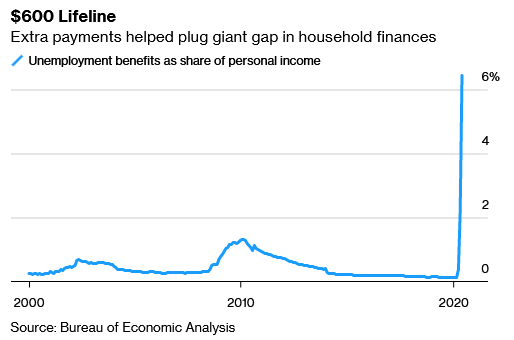

The $600 per week unemployment boost is set to end at the end of July which many are concerned about, for example new data found that Americans who received the enhanced unemployment benefits spent roughly 10% more than when they were working…. How could that be you ask, they are making more yet spending more?

Bingo, the classic issue of awful money management once again comes to haunt American families.

As you can see though, this money is/was getting gobbled up and used, plugging holes that already existed, especially now since many side gigs and primary wages are in fact down, this does pose a threat to increasing poverty. According to the Century Foundation, if the supplemental payment isn’t extended through the end of the year , the poverty rate will jump from 12.3% to 16.3% according to Washington Examiner.

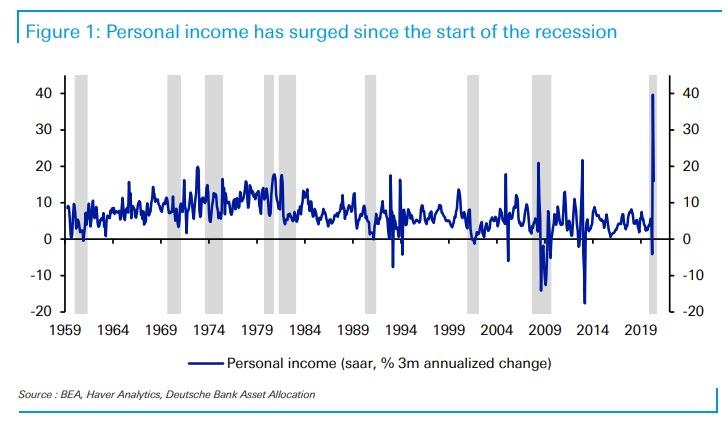

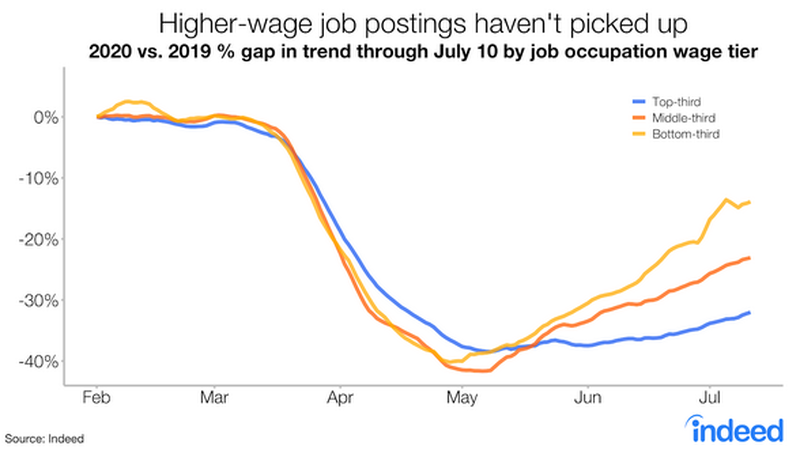

Keep in mind that low wage earners are always the hardest hit in a recession, which is what we could be seeing above, according to Becker Friedman Institute, income was still down 30% in May vs mid-Feb levels for lower earners and noting businesses have cut nominal wages for about 10% of their continuing employees.

Personal income overall has surged since the start of this recession/pandemic though according to Deutsche. Keep in mind that both the $600 lifeline chart above and the chart below is pulling data from the same Bureau of Economic Analysis. The chart below is also pulling from other data sets, just want to point that out as clearly these two charts are conflicting.

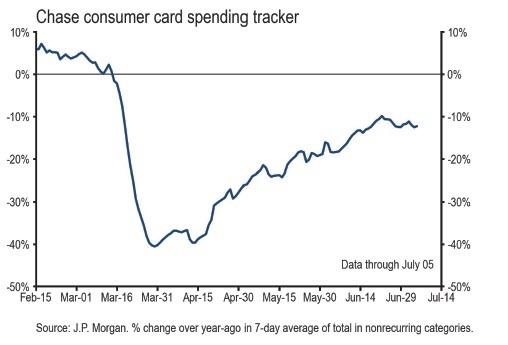

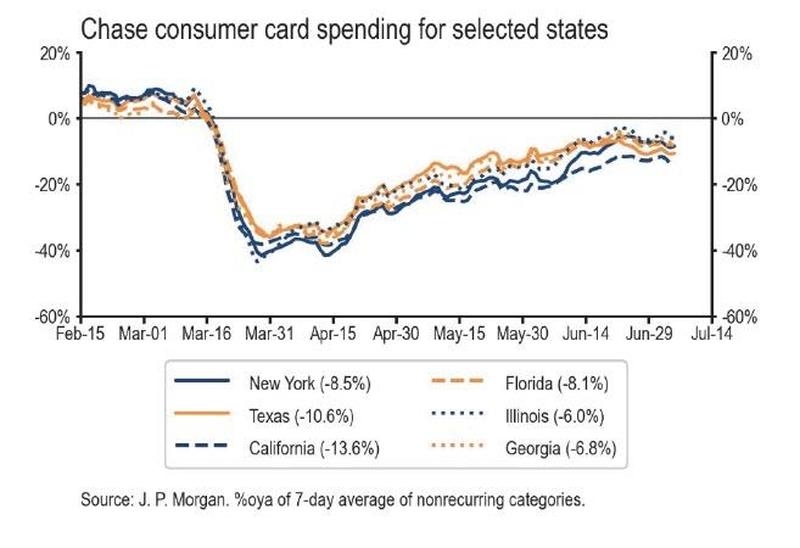

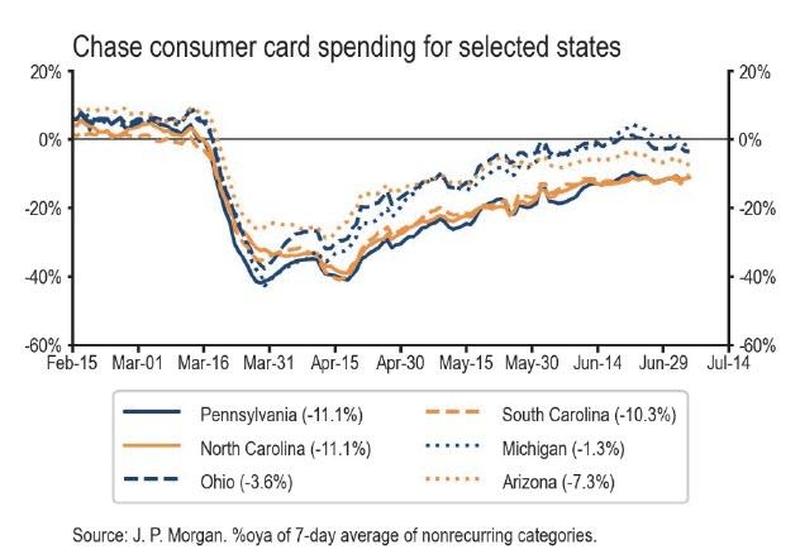

Unfortunately, both this massive government handout and this impressive spending spree are now is coming to an end, and as JPM writes, in data through Sunday, July 5, the bank’s tracker of spending by a panel of 30 million Chase credit and debit cardholders remains below its recent peak on June 22, and it appears to have flattened out at this lower level as COVID-19 spreads rapidly in some parts of the country.

Even with taking into consideration spending over July 4th weekend, there is still a noticeable pullback since the June high.

JPM also points out that the pullback in spending since late June has been widespread across states. There is some correlation between the spread of the virus over the last two weeks and the pullback in spending, but the correlation has been modest so far. This pattern suggests that there are some cautious consumers in all states who have pulled back on spending as the virus has resumed its spread, but that the rapid spread of the virus in certain states has not produced a significant change in behavior by the entire population in these states.

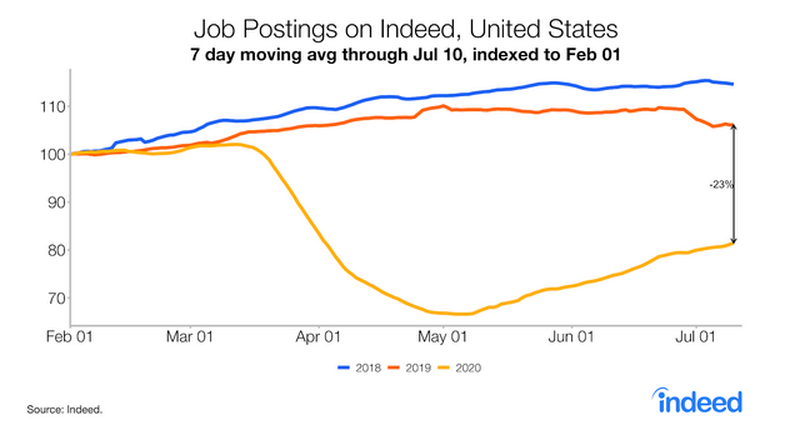

Ok back to Jobs, what about jobs right now?

A Goldman Sachs survey found that 84% of small businesses participating in the Paycheck Protection Program (PPP) are expected to exhaust their funding by the first week of August, while just 16% are confident they can continue to pay staff without more bailouts.

Meanwhile, jobs are difficult to come by. As of July 10, job postings were around 23% lower than the same period in 2019 according to Indeed.

Job postings for higher-wage occupations have dropped the most – at 32% below trend vs. 14% for lower-wage occupations.

So the job picture isn’t that great right now and when you stack the $2400 per month bonus unemployment ending this month with the fact that we still have over 8% of all mortgages are in forbearance and experts are predicting now that 20-28 million people could be evicted during all this. That is unless the Senate and House can pass a new bill that would offload the stress of backed up house payments, by either tacking it onto the end of the mortgages or similar.

As always be mindful of the data shared, some of it appears to be conflicting as its pulling from different data sets and all of it is just giving us a small part of the full picture, use at your own discretion.